Business, 16.07.2021 01:40, xoxonaynay

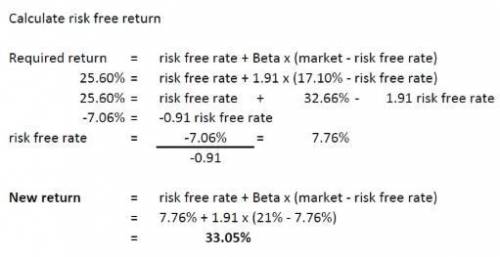

You are holding a stock that has a beta of 1.91 and is currently in equilibrium. The required return on the stock is 25.60%, and the return on the market portfolio is 17.10%. What would be the new required return on the stock if the return on the market increased to 21.00% while the risk-free rate and beta remained unchanged

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:00, necolewiggins1043

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 18:30, saneayahsimmons

What historical context does wiesel convey using the allusion of a fiery sky? he compares the sky to hell. the fires from air raids during world war ii the cremation of jews in the concentration camps the outbreak of forest fires from bombs in world war ii

Answers: 1

Business, 22.06.2019 18:50, saltytaetae

Suppose the government enacts a stimulus program composed of $600 billion of new government spending and $300 billion of tax cuts for an economy currently producing a gdp of $14 comma 000 billion. if all of the new spending occurs in the current year and the government expenditure multiplier is 1.5, the expenditure portion of the stimulus package will add nothing percentage points of extra growth to the economy. (round your response to two decimal places.)

Answers: 3

Business, 22.06.2019 19:40, apodoltsev2021

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

Do you know the correct answer?

You are holding a stock that has a beta of 1.91 and is currently in equilibrium. The required return...

Questions in other subjects:

Mathematics, 19.05.2020 22:13

Mathematics, 19.05.2020 22:13

History, 19.05.2020 22:13