The total market value of the equity of ITM is $6 million, and the total value of its debt is $4

million. The treasurer estimates that the beta of the stock currently is 1.2 and that the expected

risk premium on the market is 10%. The Treasury bill rate is 4%, and investors believe that

ITM’s debt is essentially free of default risk.

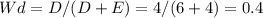

a. What is the required rate of return on ITM stock?

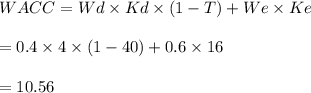

b. Estimate the WACC assuming a tax rate of 40%.

c. Estimate the discount rate for an expansion of the company’s present business.

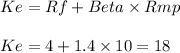

d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta

of optical manufacturers with no debt outstanding is 1.4. What is the required rate of return on

ITM’s new venture? (Assume that the risky project will not enable the firm to issue any

additional debt.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 06:00, slimt69561

When an interest-bearing note comes due and is uncollectible, the journal entry includes debitingaccounts receivable and crediting notes receivable and interest revenue. accounts receivable and crediting interest revenue. notes receivable and crediting accounts receivable and interest revenue. notes receivable and crediting accounts receivable.

Answers: 3

Business, 22.06.2019 08:00, lizisapenguin

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 11:40, derrion67

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Business, 22.06.2019 12:30, cuppykittyy

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Do you know the correct answer?

The total market value of the equity of ITM is $6 million, and the total value of its debt is $4

mi...

Questions in other subjects:

English, 16.08.2021 01:50

Mathematics, 16.08.2021 01:50

Mathematics, 16.08.2021 01:50

Mathematics, 16.08.2021 01:50

English, 16.08.2021 01:50

Mathematics, 16.08.2021 01:50

%.

%.