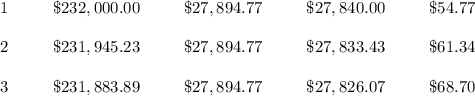

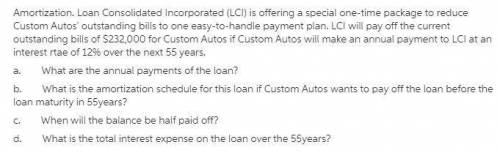

Amortization. Loan Consolidated Incorporated (LCI) is offering a special one-time package to reduce Custom Autos' outstanding bills to one easy-to-handle payment plan. LCI will pay off the current outstanding bills of $242 comma 000 for Custom Autos if Custom Autos will make an annual payment to LCI at an interest rtae of 9 % over the next 5 years. a. What are the annual payments of the loan? b. What is the amortization schedule for this loan if Custom Autos wants to pay off the loan before the loan maturity in 5 years? c. When will the balance be half paid off? d. What is the total interest expense on the loan over the 5 years?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:40, brittany7436

Astock is selling today for $50 per share. at the end of the year, it pays a dividend of $3 per share and sells for $58. a. what is the total rate of return on the stock? (enter your answer as a whole percent.) b. what are the dividend yield and percentage capital gain? (enter your answers as a whole percent.) c. now suppose the year-end stock price after the dividend is paid is $42. what are the dividend yield and percentage capital gain in this case? (negative amounts should be indicated by a minus sign. enter your answers as a whole percent.)

Answers: 1

Business, 22.06.2019 10:00, emwemily

Frolic corporation has budgeted sales and production over the next quarter as follows. the company has 4100 units of product on hand at july 1. 10% of the next months sales in units should be on hand at the end of each month. october sales are expected to be 72000 units. budgeted sales for september would be: july august september sales in units 41,500 53,500 ? production in units 45,700 53,800 58,150

Answers: 3

Business, 22.06.2019 14:00, lindjyzeph

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Do you know the correct answer?

Amortization. Loan Consolidated Incorporated (LCI) is offering a special one-time package to redu...

Questions in other subjects:

Chemistry, 03.06.2021 03:30

Mathematics, 03.06.2021 03:30

Social Studies, 03.06.2021 03:30

Mathematics, 03.06.2021 03:30

Mathematics, 03.06.2021 03:30

Mathematics, 03.06.2021 03:30