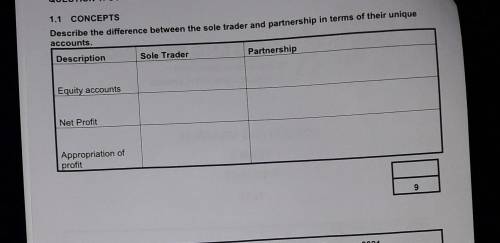

QUESTION 1: CONCEPTS AND INCOME STATEMENT 1.1 CONCEPTS Describe the difference between the sole trader and partnership in terms of their unique accounts. Description Sole Trader Partnership Equity accounts Net Profit Appropriation of profit Profit for the year ended 28 February 2021. its actually accounting not business

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:30, jluckie080117

In business, what would be the input, conversion and output of operating a summer band camp

Answers: 1

Business, 21.06.2019 21:30, anonymous1813

Balance sheet baggett company's balance sheet accounts and amounts as of december 31, 2016, are shown in random order as follows: account debit (credit) account debit (credit) income taxes payable $(3,800) additional paid-in capital on preferred prepaid items 1,800 stock $(7,900) additional paid-in capital on common stock (9,300) allowance for doubtful accounts (1,600) land 12,200 bonds payable (due 2020) (23,000) notes payable (due 2019) (6,000) buildings 57,400 notes receivable (due 2018) 16,400 sinking fund to retire bonds payable 5,000 accounts receivable 12,600 advances from customers (long-term) (2,600) premium on bonds payable (1,400) cash 4,300 accounts payable (13,100) accumulated depreciation: equipment (9,700) inventory 7,400 retained earnings (18,300) accumulated depreciation: buildings (21,000) preferred stock, $100 par (18,600) patents (net) 4,600 wages payable (1,400) equipment 28,700 common stock, $10 par (12,700) required: 1. prepare a december 31, 2016 balance sheet for the baggett. baggett company balance sheet december 31, 2016 assets current assets: $ $ $ long-term investments: $ property, plant, and equipment: $ $ $ intangible assets: liabilities current liabilities: $ $ long-term liabilities: $ $ other liabilities: shareholders' equity contributed capital: $ $ $ $ 2. compute the debt-to-assets ratio. round to one decimal place. do not enter a percent sign (%) as part of your answer. %

Answers: 1

Business, 22.06.2019 09:40, natalie2sheffield

Catherine de bourgh has one child, anne, who is 18 years old at the end of the year. anne lived at home for seven months during the year before leaving home to attend state university for the rest of the year. during the year, anne earned $6,000 while working part time. catherine provided 80 percent of anne's support and anne provided the rest. which of the following statements regarding whether anne is catherine's qualifying child for the current year is correct? a. anne is a qualifying child of catherine. b.anne is not a qualifying child of catherine because she fails the gross income test. c.anne is not a qualifying child of catherine because she fails the residence test. d.anne is not a qualifying child of catherine because she fails the support test.

Answers: 2

Business, 22.06.2019 11:00, roseemariehunter12

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e. g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Do you know the correct answer?

QUESTION 1: CONCEPTS AND INCOME STATEMENT 1.1 CONCEPTS Describe the difference between the sole trad...

Questions in other subjects:

Physics, 19.10.2019 18:50

Social Studies, 19.10.2019 18:50

Chemistry, 19.10.2019 18:50

Arts, 19.10.2019 18:50

Chemistry, 19.10.2019 18:50