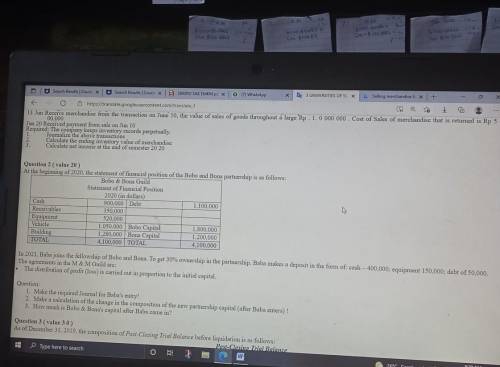

In 2021, Baba joins the fellowship of Bobo and Bona. To get 30% ownership in the partnership, Baba makes a deposit in the form of: cash – 400,000; equipment 150,000; debt of 50,000.

The agreements in the M & M Guild are:

The distribution of profit (loss) is carried out in proportion to the initial capital.

Question:

Make the required Journal for Baba's entry!

Make a calculation of the change in the composition of the new partnership capital (after Baba enters) !

How much is Bobo & Bona's capital after Baba came in?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 03:00, rafa3997

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 03:10, hipstergirl225

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 15:50, jackievelasquez7881

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 20:40, mom1645

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

Do you know the correct answer?

In 2021, Baba joins the fellowship of Bobo and Bona. To get 30% ownership in the partnership, Baba m...

Questions in other subjects:

Geography, 25.02.2021 22:50

English, 25.02.2021 22:50

History, 25.02.2021 22:50

Chemistry, 25.02.2021 22:50

Mathematics, 25.02.2021 22:50

Mathematics, 25.02.2021 22:50