Business, 21.06.2021 16:20, liltam9688

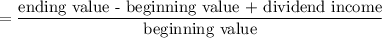

The stock of Business Adventures sells for $50 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows:

Dividend Stock price

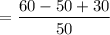

Boom $3.00 $60

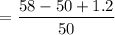

Normal economy 1.20 58

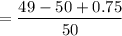

Recession .75 49

Calculate the expected holding-period return and standard deviation of the holding-period return. All three scenarios are equally likely.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:00, burnsmykala23

Excellent inc. had a per-unit conversion cost of $3.00 during april and incurred direct materials cost of $112,000, direct labor costs of $84,000, and manufacturing overhead costs of $50,400 during the month. how many units did it manufacture during the month? a. 18,000 b. 44,800 c. 70,000 d. 30,000

Answers: 1

Business, 21.06.2019 21:30, gokusupersaiyan12345

Afreezer manufacturer might purchase sheets of steel, wiring, shelving, and so forth, as part of its final product. this is an example of what sub-classification of business market?

Answers: 1

Business, 22.06.2019 15:30, gracerich

University hero is considering expanding operations beyond its healthy sandwiches. jim axelrod, vice president of marketing, would like to add a line of smoothies with a similar health emphasis. each smoothie would include two free health supplements such as vitamins, antioxidants, and protein. jim believes smoothie sales should fill the slow mid-afternoon period. adding the line of smoothies would require purchasing additional freezer space, machinery, and equipment. jim provides the following projections of net sales, net income, and average total assets in support of his proposal. sandwichesonly sandwiches and smoothies net sales $ 750,000 $ 1,350,000 net income 120,000 210,000 average total assets 350,000 750,000 return on assetschoose numerator ÷ choose denominator = return on assets÷ = return on assets÷ = profit margin÷ = profit margin÷ = asset turnover÷ = asset turnover÷ = times

Answers: 2

Business, 22.06.2019 19:30, ssiy

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Do you know the correct answer?

The stock of Business Adventures sells for $50 a share. Its likely dividend payout and end-of-year p...

Questions in other subjects:

Chemistry, 23.04.2020 04:24

Mathematics, 23.04.2020 04:24

History, 23.04.2020 04:24

Mathematics, 23.04.2020 04:24