Business, 12.06.2021 23:20, aliami0306oyaj0n

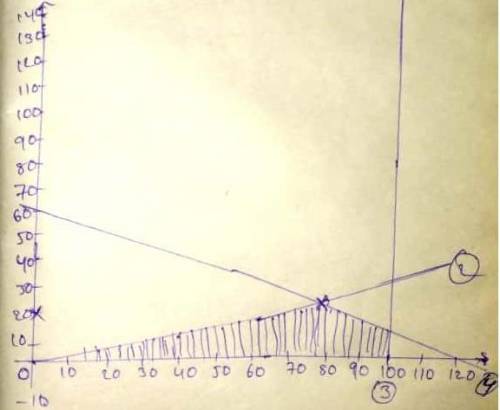

A company produces two products, A and B. The sales volume for A is at least 80% of the total salces for both A and B. However, the company cannot sell more than 100 units of A per day. Both products use one raw material, of which the maximum daily availability is 240 lb. The usage rater of the raw material are 2lb per unit of A and 4 lb per unit of B. The profit units for A and B are $20 and $50, repectively. Set this problem up as a linear program to determine the optimal product mix for the company. Then solve using excel. Next, answer the following questions: 1. How much should the company be willing to pay to increase the number of units of A that it can sell

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:30, aaroneduke4576

Consider the following scenarios. use what you have learned to decide if the goods and services being provided are individual, public, or merit goods. for each case, state what kind of good has been described and explain your answer using the definitions of individual, public, and merit goods. (6 points each) 1. from your window, you can see a city block that's on fire. you watch city firefighters rescue people and battle the flames to save the buildings. 2. while visiting relatives, you learn that your cousins attend a nearby elementary school that is supported financially by local property tax revenue. 3. you see a squadron of military jets flying overhead. 4. you find out that your aunt works for a defense manufacturing company that has several defense contracts with the government. she tells you that she works for a team that is producing a communications satellite. 5. your class visits a local jail run by a private, profit-making company that detains county criminals and is paid with tax revenue.

Answers: 1

Business, 22.06.2019 11:40, Josias13

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 13:30, OnWheels

After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of schenkel enterprises. unfortunately, you will be the only person voting for you. the company has 375,000 shares outstanding, and the stock currently sells for $40, if there are four seats in the current election, how much will it cost you to buy a seat?

Answers: 2

Do you know the correct answer?

A company produces two products, A and B. The sales volume for A is at least 80% of the total salces...

Questions in other subjects: