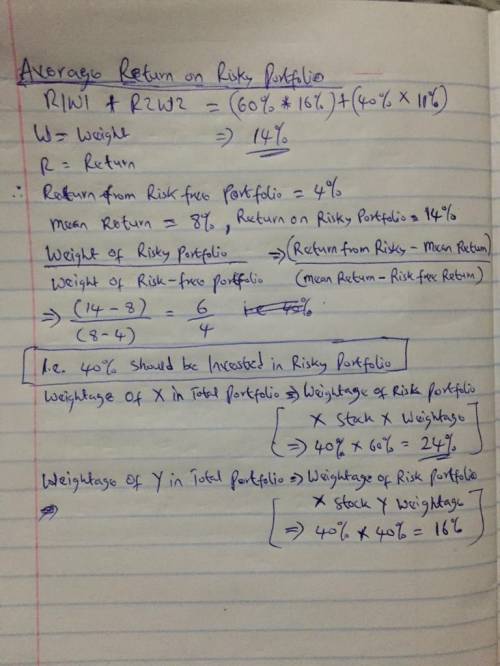

You are considering investing $2,600 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 4% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 16%, and Y has an expected rate of return of 11%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately in the risky portfolio. This will mean you will also invest approximately and of your complete portfolio in security X and Y, respectively.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:20, sophiaa23

Reqwest llc agrees to sell one hundred servers to social media networks, inc. the servers, which social media networks expressly requires to have certain amounts of memory, are to be shipped “f. o.b. social media networks distribution center in tampa, fl.” when the servers arrive, social media networks rejects them and informs reqwest, claiming that the servers do not conform to social media networks’ memory requirement. a few hours later, the servers are destroyed in a fire at social media networks’ distribution center. will reqwest succeed in a suit against social media networks for the cost of the goods?

Answers: 3

Business, 22.06.2019 08:40, Sk8terkaylee

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity. calculate the cost of new stock using the dividend growth approach. what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics. each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings. equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 12:20, mxrvin4977

In terms of precent, beer has more alcohol than whiskey true or false

Answers: 1

Do you know the correct answer?

You are considering investing $2,600 in a complete portfolio. The complete portfolio is composed of...

Questions in other subjects:

Physics, 28.07.2019 16:50

Biology, 28.07.2019 16:50

Geography, 28.07.2019 16:50

Geography, 28.07.2019 16:50