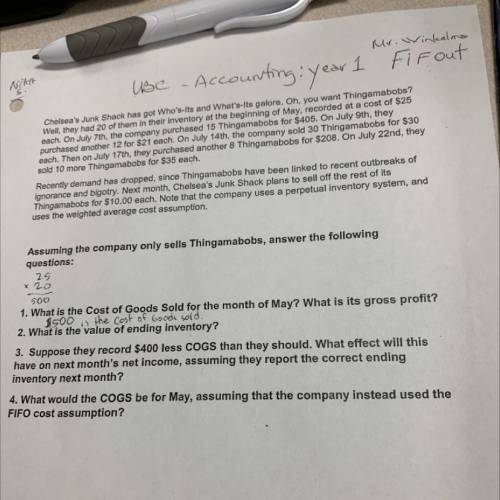

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they had 20 of them in their inventory at the beginning of May, recorded at a cost of $25

each. On July 7th, the company purchased 15 Thingamabobs for $405. On July 9th, they

purchased another 12 for $21 each. On July 14th, the company sold 30 Thingamabobs for $30

each. Then on July 17th, they purchased another 8 Thingamabobs for $208. On July 22nd, they

sold 10 more Thingamabobs for $35 each.

Recently demand has dropped, since Thingamabobs have been linked to recent outbreaks of

ignorance and bigotry. Next month, Chelsea's Junk Shack plans to sell off the rest of its

Thingamabobs for $10.00 each. Note that the company uses a perpetual inventory system, and

uses the weighted average cost assumption.

Assuming the company only sells Thingamabobs, answer the following

questions:

25

x 20

900

1. What is the Cost of Goods Sold for the month of May? What is its gross profit?

asoom the conoscono

2. What is the value of ending inventory?

3. Suppose they record $400 less COGS than they should. What effect will this

have on next month's net income, assuming they report the correct ending

inventory next month?

4. What would the COGS be for May, assuming that the company instead used the

FIFO cost assumption?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:00, ahatton15

Herman is covered by a cafeteria plan by his employer. his adjusted gross income (agi) is $100,000. he paid unreimbursed medical premiums in the amount of $10,500 and he itemizes deductions. what amount will herman be able to deduct for his medical insurance premium expenses?

Answers: 1

Business, 22.06.2019 11:00, risolatziyovudd

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 11:40, rmcarde4432

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Do you know the correct answer?

Chelsea's Junk Shack has got Who's-Its and What's-Its galore. Oh, you want Thingamabobs?

Well, they...

Questions in other subjects:

Chemistry, 01.07.2020 15:01

Physics, 01.07.2020 15:01

Mathematics, 01.07.2020 15:01