2

Retu

Part 2 of 3

1

points

Required information

Exercise 3-34 Over...

Business, 30.05.2021 20:10, daymakenna3

2

Retu

Part 2 of 3

1

points

Required information

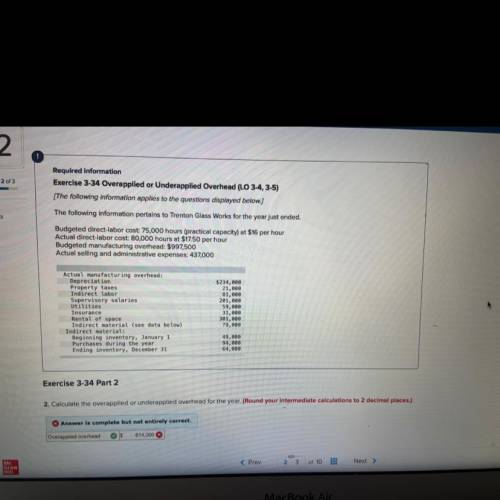

Exercise 3-34 Overapplied or Underapplied Overhead (LO 3-4,3-5)

(The following information applies to the questions displayed below.)

The following information pertains to Trenton Glass Works for the year just ended.

Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour

Actual direct-labor cost: 80,000 hours at $17.50 per hour

Budgeted manufacturing overhead: $997,500

Actual selling and administrative expenses: 437,000

Actual manufacturing overhead:

Depreciation

Property taxes

Indirect labor

Supervisory salaries

Utilities

Insurance

Rental of space

Indirect material (see data below)

Indirect material:

Beginning inventory, January 1

Purchases during the year

Ending inventory, December 31

$234,000

21,000

81,000

201,000

59,000

31,000

301,200

79,000

49,000

94,000

64,000

Exercise 3-34 Part 2

2. Calculate the overapplied or underapplied overhead for the year. (Round your intermediate calculations to 2 decimal places.)

.

Answer is complete but not entirely correct.

Overapplied overhead

$

614.000 $

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 12:30, jahkin0256

If research reveals that a company has a large number of unresolved complaints and a poor business rating, which external source did you most likely use during this research? a. blogs b. better business bureau c. social media d. local chamber of commerce e. mint global

Answers: 3

Business, 22.06.2019 17:40, treestump090

Aproduct has a demand of 4000 units per year. ordering cost is $20, and holding cost is $4 per unit per year. the cost-minimizing solution for this product is to order: ? a. 200 units per order. b. all 4000 units at one time. c. every 20 days. d. 10 times per year. e. none of the above

Answers: 3

Business, 23.06.2019 03:00, mprjug6

3. saving two consumers, larry and jeff, have utility functions defined over the two periods of their lives: middle age (period zero) and retirement (period 1). they have the same income in period 0 of m dollars and they will not earn income in period 1. the interest rate they face is r. larry’s and jeff’s utility functions are as follow. = 0.5 + 0.5 and = 0.5 + 0.5 for each person is between zero and one and represents each consumer’s temporal discount econ 340: intermediate microeconomics. ben van kammen: purdue university. rate. a. write the budget constraint that applies to both jeff and larry in terms of consumption in each period and ), interest rate, and m. b. what is larry’s and what is jeff’s marginal rate of intertemporal substitution? c. what is the slope of the budget constraint? d. write each consumer’s condition for lifetime utility maximization. e. re-arrange the conditions from part (d) to solve for the ratio, . f. if > which consumer will save more of his middle age income? g. if > 1 1+ , in which period will larry consume more: = 0 or = 1?

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Health, 19.07.2019 16:30

Social Studies, 19.07.2019 16:30

Biology, 19.07.2019 16:30

Computers and Technology, 19.07.2019 16:30