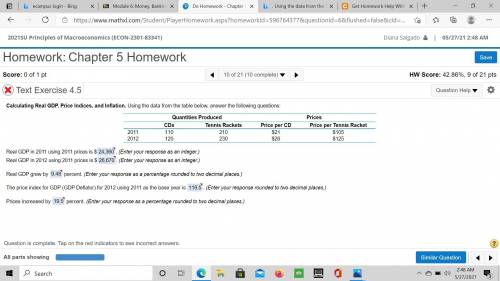

Calculating Real GDP, Price Indices, and Inflation. Using the data from the table below, answer the following questions:

Quantities Produced

Prices

CDs

Tennis Rackets

Price per CD

Price per Tennis Racket

2011

$

$

2012

$

$

Real GDP in 2011 using 2011 prices is $

24,360. (Enter your response as an integer.)

Real GDP in 2012 using 2011 prices is $

26,670. (Enter your response as an integer.)

Real GDP grew by

9.48 percent. (Enter your response as a percentage rounded to two decimal places.)

The price index for GDP (GDP Deflator) for 2012 using 2011 as the base year is

119.5. (Enter your response rounded to two decimal places.)

Prices increased by

19.5 percent. (Enter your response as a percentage rounded to two decimal places.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 08:40, Sk8terkaylee

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity. calculate the cost of new stock using the dividend growth approach. what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics. each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings. equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 11:00, littlesami105

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 12:00, jybuccaneers2022

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

Business, 22.06.2019 16:00, anonymous1813

Winners of the georgia lotto drawing are given the choice of receiving the winning amount divided equally over 2121 years or as a lump-sum cash option amount. the cash option amount is determined by discounting the annual winning payment at 88% over 2121 years. this week the lottery is worth $1616 million to a single winner. what would the cash option payout be?

Answers: 3

Do you know the correct answer?

Calculating Real GDP, Price Indices, and Inflation. Using the data from the table below, answer t...

Questions in other subjects:

English, 22.04.2021 18:40

Biology, 22.04.2021 18:40

English, 22.04.2021 18:40

Mathematics, 22.04.2021 18:40

History, 22.04.2021 18:40

Business, 22.04.2021 18:40

English, 22.04.2021 18:40