Business, 24.05.2021 14:00, Claysn9094

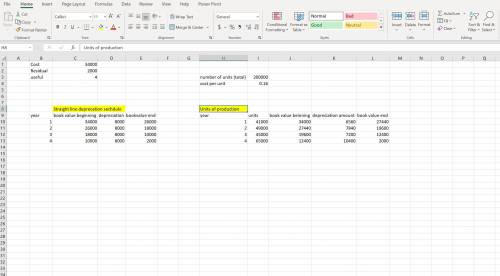

At the beginning of 2017, your company buys a $34,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of $2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 41,000 units in 2017, 49,000 units in 2018, 45,000 units in 2019, and 65,000 units in 2020.

Required:

a. Determine the depreciable cost.

b. Calculate the depreciation expense per year under the straight-line method.

c. Use the straight-line method to prepare a depreciation schedule.

d. Calculate the depreciation rate per unit under the units-of-production method.

e. Use the units-of-production method to prepare a depreciation schedule.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:20, 15krystall

Cindy recently played in a softball game in which she misplayed a ground ball for an error. later, in the same game, she made a great catch on a very difficult play. according to the self-serving bias, she would attribute her error to and her good catch to her

Answers: 1

Business, 22.06.2019 18:00, Mw3spartan17

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

Business, 22.06.2019 19:50, hdkdkdbx

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

Business, 22.06.2019 21:10, chimwim7515

The chromosome manufacturing company produces two products, x and y. the company president, jean mutation, is concerned about the fierce competition in the market for product x. she notes that competitors are selling x for a price well below chromosome's price of $13.50. at the same time, she notes that competitors are pricing product y almost twice as high as chromosome's price of $12.50.ms. mutation has obtained the following data for a recent time period: product x product y number of units 11,000 3,000 direct materials cost per unit $3.23 $3.09 direct labor cost per unit $2.22 $2.10 direct labor hours 10,000 3,500 machine hours 2,100 1,800 inspection hours 80 100 purchase orders 10 30ms. mutation has learned that overhead costs are assigned to products on the basis of direct labor hours. the overhead costs for this time period consisted of the following items: overhead cost item amount inspection costs $16,200 purchasing costs 8,000 machine costs 49,000 total $73,200using direct labor hours to allocate overhead costs determine the gross margin per unit for product x. choose the best answer from the list below. a. $1.93b. $3.12c. $7.38d. $2.43e. $1.73using activity-based costing for overhead allocation, determine the gross margin per unit for product y. choose best answer from list below. a. $10.07b. ($2.27)c. ($5.23)d. ($7.02)e. $7.02

Answers: 3

Do you know the correct answer?

At the beginning of 2017, your company buys a $34,000 piece of equipment that it expects to use for...

Questions in other subjects:

Mathematics, 19.07.2019 15:30

English, 19.07.2019 15:30

Mathematics, 19.07.2019 15:30