Business, 11.05.2021 22:40, ekerns2000paa19x

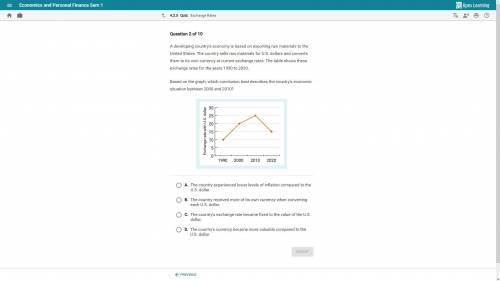

A developing country's economy is based on exporting raw materials to the United States. The country sells raw materials for U. S. dollars and converts them to its own currency at current exchange rates. The table shows these exchange rates for the years 1990 to 2020.

Based on the graph, which conclusion best describes the country's economic situation between 2000 and 2010?

A. The country experienced lower levels of inflation compared to the U. S

B. The country received more of its own currency when converting each U. S. dollar.

C. The country's exchange rate became fixed to the value of the U. S. dollar.

D. The country's currency became more valuable compared to the U. S. dollar.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:10, chloeholt123

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 13:50, 2023apd

Diamond motor car company produces some of the most luxurious and expensive cars in the world. typically, only a single dealership is authorized to sell its cars in certain major cities. in less populous areas, diamond authorizes a single dealer for an entire state or region. the manufacturer of diamond automobiles is using a(n) distribution strategy for its product.

Answers: 2

Business, 22.06.2019 19:30, jeanlucceltrick09

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 23:30, ameliaxbowen7

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

Do you know the correct answer?

A developing country's economy is based on exporting raw materials to the United States. The country...

Questions in other subjects:

History, 11.07.2019 05:30

Biology, 11.07.2019 05:30

Mathematics, 11.07.2019 05:30

History, 11.07.2019 05:30

Biology, 11.07.2019 05:30

Mathematics, 11.07.2019 05:30

History, 11.07.2019 05:30

Social Studies, 11.07.2019 05:30