Business, 11.05.2021 03:30, KillerSteamcar

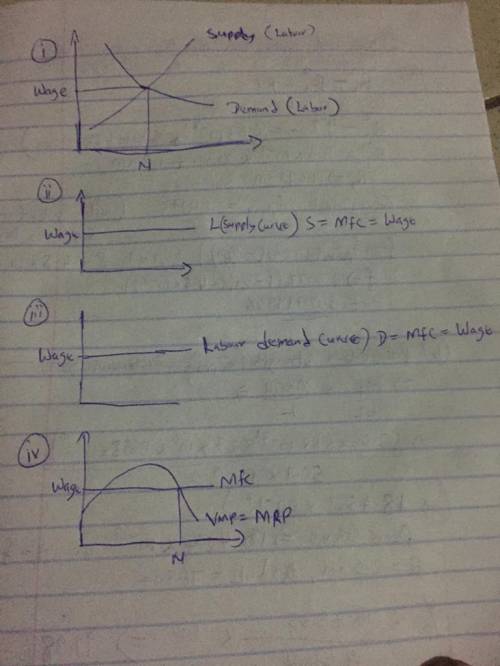

13. A firm hires its labor in a perfectly competitive factor (or resource) market and sells its product in a perfectly competitive product market. a. Using correctly labeled side-by-side graphs, show each of the following: i. The equilibrium wage rate in the market ii. The labor supply curve the firm faces iii. The demand curve the firm faces iv. The number of workers that the firm hires

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, kay4358

What are the main advantages and disadvantages of organizing a firm as a c corporation? the advantages are: (select all the choices that apply.) a. there is no limit on the number of owners a c corporation may have, thus allowing the corporation to raise substantial amounts of capital. b. the life of the business can continue beyond the death of any of the owners. c. the corporation can use the assets of the owners to pay for corporate liabilities. this attracts smaller investors to the corporation. d. the liability of the owners is limited to the amount of their investment in the firm. the disadvantages are: (select all the choices that apply.) a. income to a c corporation is subject to double taxation, once at the corporate level and again when received by the owners in the form of a dividend. b. the life of the business usually ends with the death of any of the owners. c. the c corporation is more complicated and more expensive to set up than other business entities. d. corporate liabilities can be passed on to the share

Answers: 1

Business, 22.06.2019 04:10, jennifer9983

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company’s discount rate is 18%. after careful study, oakmont estimated the following costs and revenues for the new product: cost of equipment needed $ 230,000 working capital needed $ 84,000 overhaul of the equipment in year two $ 9,000 salvage value of the equipment in four years $ 12,000 annual revenues and costs: sales revenues $ 400,000 variable expenses $ 195,000 fixed out-of-pocket operating costs $ 85,000 when the project concludes in four years the working capital will be released for investment elsewhere within the company. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

Answers: 2

Business, 22.06.2019 18:00, cj31150631

Interpreting the income tax expense footnote the income tax footnote to the financial statements of fedex corporation follows. the components of the provision for income taxes for the years ended may 31 were as follows: ($ millions) 2010 2009 2008 current provision domestic federal $ 36 $ (35) $ 514 state and local 54 18 74 foreign 207 214 242 297 197 830 deferred provisions (benefit) domestic federal 408 327 31 state and local 15 48 (2) foreign (10) 7 32 413 382 61 provision for income taxes $ 710 $ 579 $ 891 (a)what is the amount of income tax expense reported in fedex's 2010, 2009, and 2008 income statements?

Answers: 2

Business, 22.06.2019 19:50, wsdafvbhjkl

On july 7, you purchased 500 shares of wagoneer, inc. stock for $21 a share. on august 1, you sold 200 shares of this stock for $28 a share. you sold an additional 100 shares on august 17 at a price of $25 a share. the company declared a $0.95 per share dividend on august 4 to holders of record as of wednesday, august 15. this dividend is payable on september 1. how much dividend income will you receive on september 1 as a result of your ownership of wagoneer stock

Answers: 1

Do you know the correct answer?

13. A firm hires its labor in a perfectly competitive factor (or resource) market and sells its prod...

Questions in other subjects:

Mathematics, 22.04.2021 21:30

Mathematics, 22.04.2021 21:30

Mathematics, 22.04.2021 21:30

Mathematics, 22.04.2021 21:30

Business, 22.04.2021 21:30