Business, 07.05.2021 09:30, lakenyahar

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a sweet home to reward all his hard work; his dream home costs $550,000

Has been sloppy in the past with his bill pay, leading to a credit score of 670, so the best rate he can get is 4.26% for 30 years fixed

Is willing to contribute $75,000 to his down payment

How much, per month, is Bryce short on the mortgage payments for his dream home?

$

How much would Bryce’s down payment need to be if he wanted to get his monthly payments down to $2,500 or slightly under?

Using this strategy, how much total interest would he pay over the course of the loan?

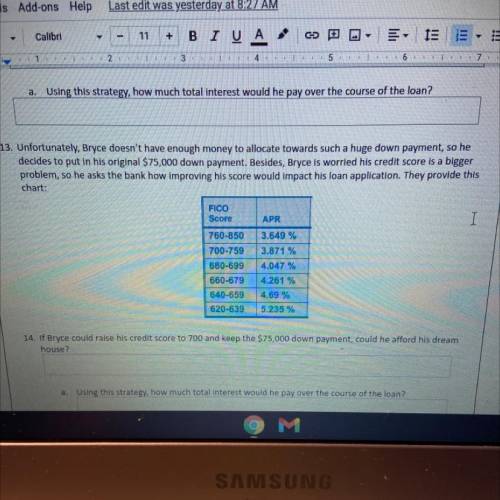

Unfortunately, Bryce doesn’t have enough money to allocate towards such a huge down payment, so he decides to put in his original $75,000 down payment. Besides, Bryce is worried his credit score is a bigger problem, so he asks the bank how improving his score would impact his loan application. They provide this chart:

If Bryce could raise his credit score to 700 and keep the $75,000 down payment, could he afford his dream house? (760-850 = 3.649%, 700-759 = 3.871%, 680-699 = 4.047%, 660-679 = 4.261%, 640-659 = 4.69%, 620-639 = 5.235%)

Using this strategy, how much total interest would he pay over the course of the loan?

What do you think Bryce should do?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:00, hahalol123goaway

Which law would encourage more people to become homeowners but not encourage risky loans that could end in foreclosure? options: offering first time homebuyers tax-free accounts to save for down payments requiring all mortgages to be more affordable, interest-only loans outlawing home inspections and appraisals by mortgage companies limiting rent increases to less than 2% a year

Answers: 2

Business, 22.06.2019 05:00, and7393

Xie company identified the following activities, costs, and activity drivers for 2017. the company manufactures two types of go-karts: deluxe and basic. activity expected costs expected activity handling materials $ 625,000 100,000 parts inspecting product 900,000 1,500 batches processing purchase orders 105,000 700 orders paying suppliers 175,000 500 invoices insuring the factory 300,000 40,000 square feet designing packaging 75,000 2 models required: 1. compute a single plantwide overhead rate, assuming that the company assigns overhead based on 125,000 budgeted direct labor hours. 2. in january 2017, the deluxe model required 2,500 direct labor hours and the basic model required 6,000 direct labor hours. assign overhead costs to each model using the single plantwide overhead rate.

Answers: 3

Business, 22.06.2019 17:50, Senica

Bandar industries berhad of malaysia manufactures sporting equipment. one of the company’s products, a football helmet for the north american market, requires a special plastic. during the quarter ending june 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. the plastic cost the company $171,000. according to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a cost of $8 per kilogram. 1. what is the standard quantity of kilograms of plastic (sq) that is allowed to make 35,000 helmets? 2. what is the standard materials cost allowed (sq x sp) to make 35,000 helmets? 3. what is the materials spending variance? 4. what is the materials price variance and the materials quantity variance?

Answers: 1

Business, 22.06.2019 18:00, kekoanabor19

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

Do you know the correct answer?

BRYCE: Has a high paying job and has determined he could afford up to $2700 per month

Wants a swee...

Questions in other subjects:

Mathematics, 27.02.2021 19:40

Mathematics, 27.02.2021 19:40

Law, 27.02.2021 19:40