Business, 01.01.2020 10:31, natiem1803

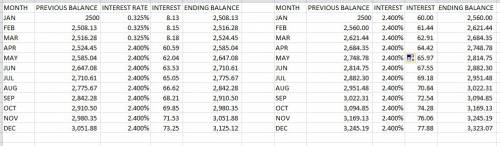

Leyla transferred a balance of $2500 to a new credit card at the beginning of the year. the card offered an introductory apr of 3.9% for the first 3 months and a standard apr of 28.8% for the rest of the year. leyla made no payments or new purchases during the year, and she wasn't charged any late payment fees. the credit card compounds interest monthly. leyla figure out how much money the introductory apr saved her over the course of the year. (5 points: part i – 1 point; part ii – 1 point; part iii – 1 point; part iv – 1 point; part v – 1 point) part i: what was leyla's balance at the end of the introductory period? part ii: for how many months during the year did leyla have the standard apr? part iii: what was leyla's balance at the end of the year? part iv: what would leyla's balance have been at the end of the year had there not been an introductory apr? part v: how much money did the introductory apr save leyla over the course of the year?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:30, khohenfeld0

Actual usage for the year by the marketing department was 70,000 copies and by the operations department was 330,000 copies. if a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the operations department?

Answers: 2

Business, 22.06.2019 15:00, WowOK417

Which of the following characteristics are emphasized in the accounting for state and local government entities? i. revenues should be matched with expenditures to measure success or failure of the government entity. ii. there is an emphasis on expendability of resources to accomplish objectives. a. i only b. ii only c. i and ii d. neither i nor ii

Answers: 2

Business, 22.06.2019 22:00, mdaniella522

In 2018, laureen is currently single. she paid $2,800 of qualified tuition and related expenses for each of her twin daughters sheri and meri to attend state university as freshmen ($2,800 each for a total of $5,600). sheri and meri qualify as laureen’s dependents. laureen also paid $1,900 for her son ryan’s (also laureen’s dependent) tuition and related expenses to attend his junior year at state university. finally, laureen paid $1,200 for herself to attend seminars at a community college to her improve her job skills. what is the maximum amount of education credits laureen can claim for these expenditures in each of the following alternative scenarios? a. laureen's agi is $45,000.b. laureen’s agi is $95,000.c. laureen’s agi is $45,000 and laureen paid $12,000 (not $1,900) for ryan to attend graduate school (i. e, his fifth year, not his junior year).

Answers: 2

Do you know the correct answer?

Leyla transferred a balance of $2500 to a new credit card at the beginning of the year. the card off...

Questions in other subjects:

English, 12.10.2019 06:10

Mathematics, 12.10.2019 06:10

History, 12.10.2019 06:10

Mathematics, 12.10.2019 06:10

Mathematics, 12.10.2019 06:10

English, 12.10.2019 06:10