1

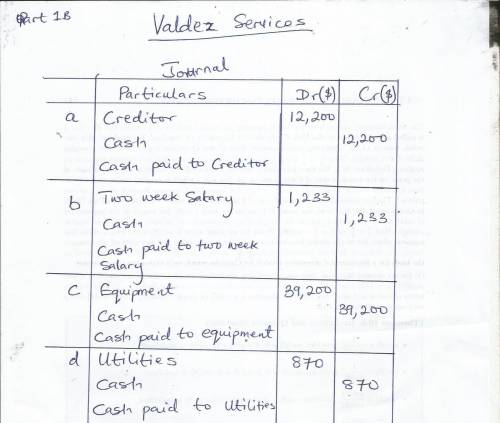

following are the transactions for valdez services.

following are the transactions fo...

Business, 25.08.2019 20:00, ruffnekswife

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and

1

following are the transactions for valdez services.

following are the transactions for valdez services.

a.

the company paid $12,200 cash for payment on a 16-month old liability for office supplies.

b.

the company paid $1,233 cash for the just completed two-week salary of the receptionist.

c.

the company paid $39,200 cash for equipment purchased.

d.

the company paid $870 cash for this month's utilities.

e.

owner (valdez withdrew $4,500 cash from the company for personal use.

examine the above transactions and identify those that create expenses for valdez services. (you may select more than one answer. click the box with a check mark for correct answers and click to empty the box for the wrong answers.

transaction

a.

transaction

b.

transaction

c.

transaction

d.

transaction

e.

prepare general journal entries to record those transactions that created expenses in the above given order.

2

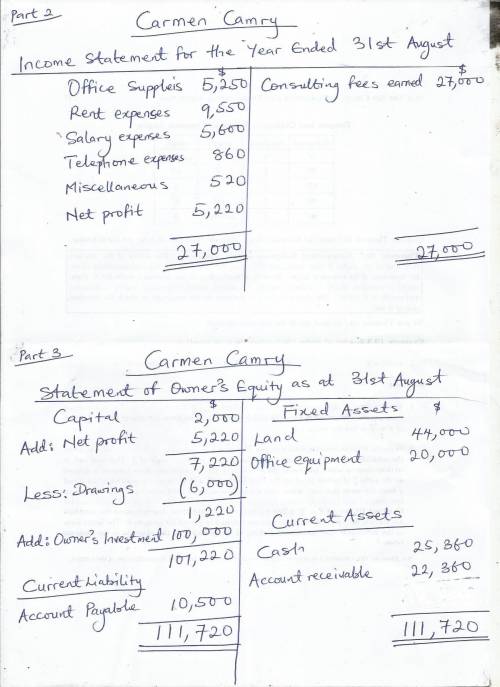

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august income statement for the business.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

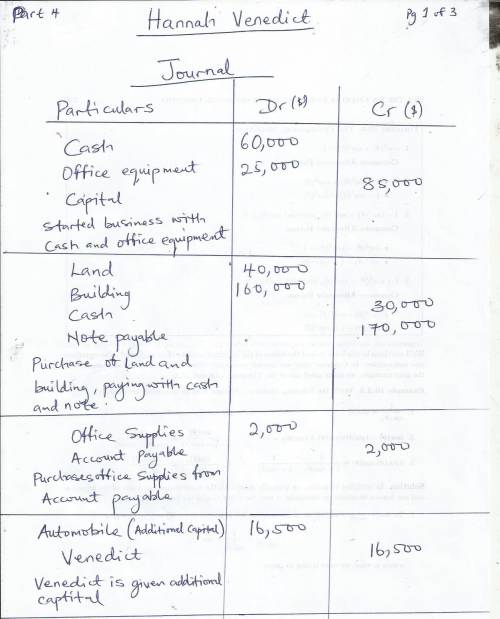

3

carmen camry operates a consulting firm called today. on august 31, the company's records show the following accounts and amounts for the month of august. use this information to prepare an august statement of owner's equity for today.

cash

$

25,360

c. camry, withdrawals

$

6,000

accounts receivable

22,360

consulting fees earned

27,000

office supplies

5,250

rent expense

9,550

land

44,000

salaries expense

5,600

office equipment

20,000

telephone expense

860

accounts payable

10,500

miscellaneous expense

520

c. camry, capital, july 31

2,000

owner investment made on august 4

100,000

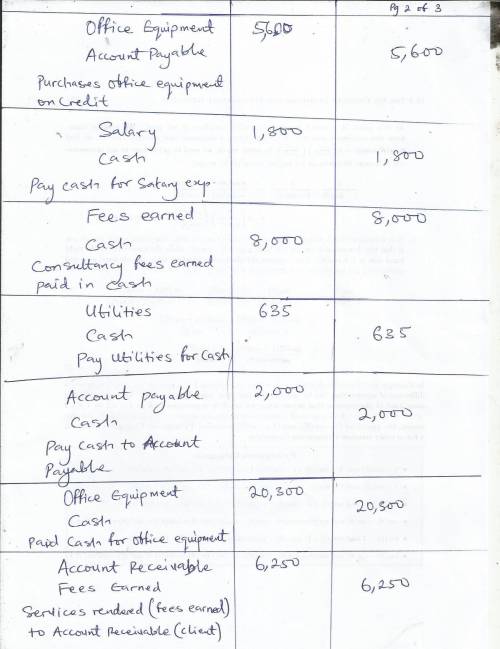

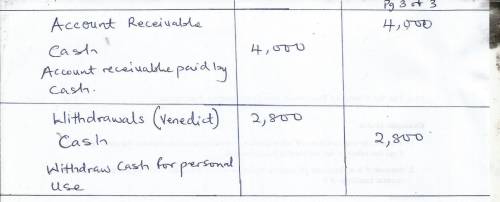

4

business transactions completed by hannah venedict during the month of september are as follows.

a.

venedict invested $60,000 cash along with office equipment valued at $25,000 in a new sole proprietorship named hv consulting.

b.

the company purchased land valued at $40,000 and a building valued at $160,000. the purchase is paid with $30,000 cash and a long-term note payable for $170,000.

c.

the company purchased $2,000 of office supplies on credit.

d.

venedict invested her personal automobile in the company. the automobile has a value of $16,500 and is to be used exclusively in the business.

e.

the company purchased $5,600 of additional office equipment on credit.

f.

the company paid $1,800 cash salary to an assistant.

g.

the company provided services to a client and collected $8,000 cash.

h.

the company paid $635 cash for this month's utilities.

i.

the company paid $2,000 cash to settle the account payable created in transaction

c.

j.

the company purchased $20,300 of new office equipment by paying $20,300 cash.

k.

the company completed $6,250 of services for a client, who must pay within 30 days.

l.

the company paid $1,800 cash salary to an assistant.

m.

the company received $4,000 cash in partial payment on the receivable created in transaction k.

n.

venedict withdrew $2,800 cash from the company for personal use.

required:

required:

1.

prepare general journal entries to record these transactions using the following titles: cash (101; accounts receivable (106; office supplies (108; office equipment (163; automobiles (164; building (170; land (172; accounts payable (201; notes payable (250; h. venedict, capital (301; h. venedict, withdrawals (302; fees earned (402; salaries expense (601; and utilities expense (602.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:50, emmanuelcampbel

What happens when a bank is required to hold more money in reserve?

Answers: 3

Business, 22.06.2019 01:30, hollymay808p0t9to

At the end of the week, carla receives her paycheck and goes directly to the bank after work to make a deposit into her savings account. the bank keeps the required reserve and then loans out the remaining balance to a qualified borrower named malik as a portion of his small business loan. malik uses the loan to buy a tractor for his construction business and makes small monthly payments to the bank to payback the principal balance plus interest on the loan. the bank profits from a portion of the interest payment received and also passes some of the interest back to carla in the form of an interest payment to her savings account. in this example, the bank is acting

Answers: 1

Business, 22.06.2019 12:30, victorialeona81

Provide an example of open-ended credit account that caroline has. caroline blue's credit report worksheet.

Answers: 1

Do you know the correct answer?

Questions in other subjects:

World Languages, 27.01.2021 14:00

Physics, 27.01.2021 14:00

Biology, 27.01.2021 14:00

Mathematics, 27.01.2021 14:00

Business, 27.01.2021 14:00

Mathematics, 27.01.2021 14:00