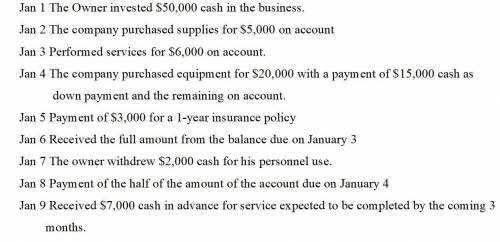

On January 1, the journal entry is *

Debit Cash $50,000, Credit Owner’s Capital $50,000

Debit...

Business, 09.04.2021 14:00, mettababeeeee

On January 1, the journal entry is *

Debit Cash $50,000, Credit Owner’s Capital $50,000

Debit Cash $50,000, Credit Service Revenue $50,000

Debit Cash $50,000, Credit Account Payable $50,000

None of the above

On January 2, the journal entry is *

Debit Cash $5,000, Credit Supplies $5,000

Debit Supplies $5,000, Credit Cash $5,000

Debit supplies $5,000, Credit Account Payable $5,000

None of the above

On January 3, the journal entry is *

Debit Cash $6,000, Credit Service Revenues $6,000

Debit Account Receivable $6,000, Credit Service Revenues $6,000

Debit Account Receivable $6,000, Credit Unearned Revenues $6,000

None of the above

On January 4, the journal entry is *

Debit Equipment $15,000, Credit Cash $15,000

Debit Cash $15,000 and Debit Account receivable $5,000, Credit Equipment $20,000

Debit Equipment $20,000, Credit Account payable $20,000

None of the above

On January 5, the journal entry is *

Debit Prepaid insurance $3,000, Credit Account Payable $3,000

Debit Insurance expenses $3,000, Credit Cash $3,000

Credit Prepaid insurance $3,000, Debit Cash $3,000

None of above

On January 6, the journal entry is *

Debit Cash $6,000, Credit $6,000 Account Receivable

Credit Cash $6,000, Debit $6,000 Account Receivable

Debit Cash $3,000, Credit $3,000 Account Receivable

None of the above

On January 7, the journal entry is *

Credit Owner’s drawings, Debit Cash

Debit Owner’s capital, Credit Cash

Debit Owner’s drawings, Credit Cash

None of the above

On January 8, the journal entry is *

Debit Account Payable $2,500, Credit Cash $2,500

Debit Account Payable $5,000, Credit Cash $5,000

Debit Account Receivable $5,000, Credit Cash $5,000

None of the above

On January 9, the journal entry is *

Debit Cash $7,000, Credit Service Revenues $7,000

Debit Cash $7,000, Credit Unearned Revenues $7,000

Credit Cash $7,000, Debit Unearned Revenues $7,000

None of the above

The balance of cash at the end of January 5 is *

$32,000

$40,500

$22,500

None of the above

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:30, kingtrent81

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $385,000; cash paid for rent, $49,000; cash paid to employees for services rendered during the year, $129,000; cash paid for utilities, $59,000. in addition, you determine that customers owed the company $69,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,900 at year-end, and the rent payment was for a two-year period.

Answers: 1

Business, 22.06.2019 22:20, ciara180

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic. b. a tax burden falls more heavily on the side of the market that is less elastic. c. a tax burden falls more heavily on the side of the market that is closer to unit elastic. d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

Business, 22.06.2019 22:50, chrisraptorofficial

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Mathematics, 29.10.2019 06:31

English, 29.10.2019 06:31

Mathematics, 29.10.2019 06:31

History, 29.10.2019 06:31