Business, 29.03.2021 01:00, hollodom9654

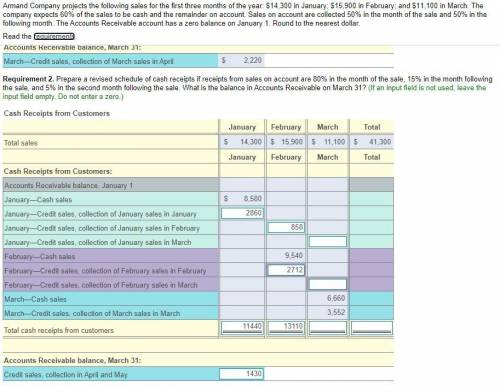

Armand Company projects the following sales for the first three months of the year: $14,300 in January; $15,900 in February; and $11,100 in March. The company expects %60 of the sales to be cash and the remainder on account. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Accounts Receivable account has a zero balance on January 1. Round to the nearest dollar.

Requirement 2. Prepare a revised schedule of cash receipts if receipts from sales on account are 80% in the month of the sale, 15% in the month following the sale, and 5% in the second month following the sale. What is the balance in Accounts Receivable on March 31?

Help me solve it step by step please!

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:00, nyceastcoast

How does having a flexible mind you become a better employee? a. it you become more honest toward work. b. it you become a team player. c. it you learn new things that will better your performance. d. it you to finish your work on time. e. it you reach work on time

Answers: 1

Business, 22.06.2019 14:30, ayoismeisjjjjuan

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 20:20, baby851

You are the cfo of a u. s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u. s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 22.06.2019 22:10, jpimentel2021

What is private equity investing? who participates in it and why? how is palamon positioned in the industry? how does private equity investing compare with public market investing? what are the similarities and differences between the two? why is palamon interested in teamsystem? does it fit with palamon’s investment strategy? how much is 51% of teamsystem’s common equity worth? use both a discounted cash flow and a multiple-based valuation to justify your recommendation. what complexities do cross-border deals introduce? what are the specific risks of this deal? what should louis elson recommend to his partners? is it a go or not? if it is a go, what nonprice terms are important? if it’s not a go, what counterproposal would you make?

Answers: 1

Do you know the correct answer?

Armand Company projects the following sales for the first three months of the year: $14,300 in Janu...

Questions in other subjects:

Geography, 26.10.2021 05:50

Mathematics, 26.10.2021 05:50

Mathematics, 26.10.2021 05:50

History, 26.10.2021 05:50

English, 26.10.2021 05:50

Biology, 26.10.2021 05:50

Biology, 26.10.2021 05:50