Business, 26.03.2021 15:30, patworsley

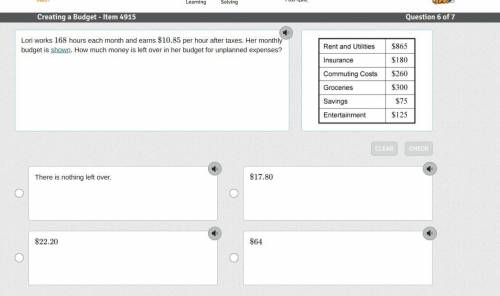

Lori works 168 hours each month and earns $10.85 per hour after taxes. Her monthly budget is shown. How much money is left over in her budget for unplanned expenses?PLS HELP I WILL GIVE BRAINLIST TO WHO THE CORRECT ASNWER

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 21:50, reggiegilbert1995

Varto company has 9,400 units of its sole product in inventory that it produced last year at a cost of $23 each. this year’s model is superior to last year’s, and the 9,400 units cannot be sold at last year’s regular selling price of $42 each. varto has two alternatives for these items: (1) they can be sold to a wholesaler for $8 each, or (2) they can be reworked at a cost of $251,100 and then sold for $34 each. prepare an analysis to determine whether varto should sell the products as is or rework them and then sell them.

Answers: 2

Business, 23.06.2019 03:00, sahaitong2552

What is the w-4 form used for? filing taxes with the federal government determining the amount of money an employee has paid out in taxes calculating how much tax should be withheld from a person’s paycheck calculating how much income was paid in the previous year

Answers: 1

Business, 24.06.2019 01:30, lisamiller

At the red apple health food store, employees earn time and a half for any hours they work in addition to their regular 35-hour work week. nicole logan is paid $8.00 an hour. this week she worked 46.25 hours. what is her total pay? $355 $380 $370 $415

Answers: 3

Do you know the correct answer?

Lori works 168 hours each month and earns $10.85 per hour after taxes. Her monthly budget is shown....

Questions in other subjects:

Physics, 11.05.2021 03:50

Geography, 11.05.2021 03:50

Mathematics, 11.05.2021 03:50

English, 11.05.2021 03:50