Business, 24.03.2021 17:20, mikaylarichardson96

Karr, Inc. reported net income of $300,000 for 20X4. Changes occurred in several Balance Sheet accounts as follows:

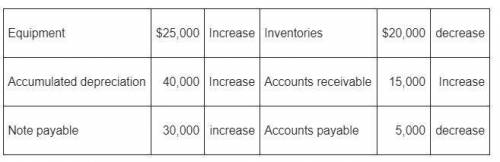

Equipment $25,000 increase Accumulated depreciation $40,000 increase Note payable $30,000 increase Additional information:

1. During 20X4, Karr sold equipment costing $25,000, with accumulated depreciation of $12,000, for a gain of $5,000.

2. In December 20X4, Karr purchased equipment costing $50,000 with $20,000 cash and a 12% note payable of $30,000.

3. Depreciation expense for the year was $52,000. In Karr's 20X4 Statement of Cash Flows, net cash provided by operating activities should be

Required:

1. In Karr's 2011 statement of cash flows, calculate net cash provided by operating activities.

2. In Karr's 2011 statement of cash flows, calculate net cash used in investing activities.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:10, elijahcarson9015

Complete the sentences. upper a decrease in current income taxes the supply of loanable funds today because it a. decreases; increases disposable income, which decreases saving b. has no effect on; doesn't change expected future disposable income c. decreases; decreases expected future disposable income d. increases; increases disposable income, which encourages greater saving upper a decrease in expected future income a. increases the supply of loanable funds today because households with smaller expected future income will save more today b. has no effect on the supply of loanable funds c. decreases the supply of loanable funds because it decreases wealth d. decreases the supply of loanable funds today because households with smaller expected future income will save less today

Answers: 3

Business, 22.06.2019 09:50, niele123

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 22.06.2019 10:10, travisvb

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 11:00, jilliand2030

Why are the four primary service outputs of spatial convenience, lot size, waiting time, and product variety important to logistics management? provide examples of competing firms that differ in the level of each service output provided to customers?

Answers: 1

Do you know the correct answer?

Karr, Inc. reported net income of $300,000 for 20X4. Changes occurred in several Balance Sheet accou...

Questions in other subjects:

Arts, 15.11.2020 15:00

Chemistry, 15.11.2020 15:00

Health, 15.11.2020 15:00

Computers and Technology, 15.11.2020 15:00

English, 15.11.2020 15:00

Chemistry, 15.11.2020 15:10