These are the choices fill in the blanks.

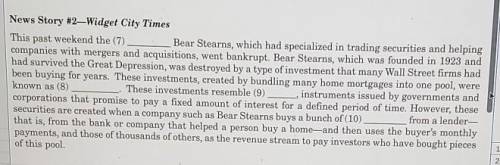

asset backed security bank run

credit default swap....

Business, 22.03.2021 19:50, liamgreene90

These are the choices fill in the blanks.

asset backed security bank run

credit default swap. capital

bond. credit

common stock. credit crunch

mortgage-backed securities. debt

mutual fund. default

option. equity

futures contract. foreclosure

subprime mortgage. leverage

central bank. liquidity

commercial bank. liquidity risk

hedge fund. moral hazard

investment bank. mortgage

fannie mae/ freddie mac. nationalization

federal deposit insurance corporation regulation

federal reserve system. return

private equity fund

risk

securitization

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:00, skgoldsmith

Symantec corp., located in cupertino, california, is one of the world's largest producers of security and systems management software. the company's consolidated balance sheets for the 2009 and 2008 fiscal years included the following ($ in thousands): current assets: receivables, less allowances of $21,766 in 2009 and $24,089 in 2008 $ 838,010 $ 758,700 a disclosure note accompanying the financial statements reported the following ($ in thousands): year ended 2009 2008 (in thousands) trade accounts receivable, net: receivables $ 859,776 $ 782,789 less: allowance for doubtful accounts (8,938) (8,990) less: reserve for product returns (12,828) (15,099) trade accounts receivable, net: $ 838,010 $ 758,700 assume that the company reported bad debt expense in 2009 of $2,000 and had products returned for credit totaling $3,230 (sales price). net sales for 2009 were $6,174,800 (all numbers in thousands).required: what is the amount of accounts receivable due from customers at the end of 2009 and 2008? what amount of accounts receivable did symentec write off during 2009? what is the amount of symentec’s gross sales for the 2009 fiscal year? assuming that all sales are made on a credit basis, what is the amount of cash symentec collected from customers during the 2009 fiscal year?

Answers: 3

Business, 22.06.2019 04:40, glenn4572

Select the correct text in the passage. which sentences in the given passage explains the limitations of monetary policies? monetary policies - limitationsmonetary policies are set by the central bank to bring about growth in the economy. de can be achieved these policiesw at anden i sca poit would be fair to say that changes in the economy cannot be brought about instantly by monetary po des. monetary policy can only influence not control, economic growththe monetary policy makers do work on sining the perfect balance between demand and supply of money in the economy

Answers: 3

Business, 22.06.2019 12:40, payshencec21

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 22.06.2019 15:40, brookekolmetz

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

Do you know the correct answer?

Questions in other subjects:

History, 25.10.2019 16:43

History, 25.10.2019 16:43

English, 25.10.2019 16:43

Mathematics, 25.10.2019 16:43

Computers and Technology, 25.10.2019 16:43

English, 25.10.2019 16:43