Business, 19.03.2021 23:10, zdejesus4994

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 94%

Break Company issues $900,000 of 10%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 114%

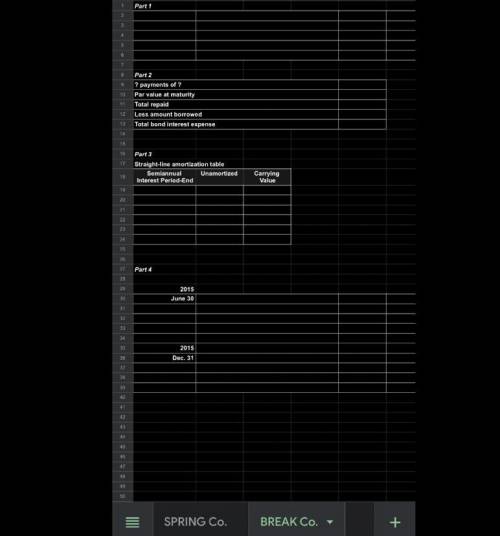

Required for EACH company

Prepare the January 1, 2015, journal entry to record the bonds' issuance.

Determine the total bond interest expense to be recognized over the bonds' life.

Prepare a straight-line amortization table for the bonds' first two years.

Prepare the journal entries to record the first two interest payments. m

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:20, kota87

On january 1, jackson, inc.'s work-process inventory account showed a balance of $ 66,500. during the year, materials requisitioned for use in production amounted to $ 70,500, of which $ 67,700 represented direct materials. factory wages for the period were $ 210,000 of which $ 187,000 were for direct labor. manufacturing overhead is allocated on the basis of 60% of direct labor cost. actual overhead was $ 116,050. jobs costing $ 353,060 were completed during the year. the december 31 balance in work-process inventory is

Answers: 1

Business, 22.06.2019 03:00, arionaking59p71cfc

Match the given situations to the type of risks that a business may face while taking credit.(there's not just one answer)1. beta ltd. had taken a loan from a bankfor a period of 15 years, but its salesare gradually showing a decline.2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any researchbefore making this decision.3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession.4. delphi ltd. has taken a short-term loanfrom the bank, but its supply chain logistics are not in place. a. foreign exchange riskb. operational riskc. term of loan riskd. revenue projections risk

Answers: 1

Business, 22.06.2019 07:00, Maria3737

For the past six years, the price of slippery rock stock has been increasing at a rate of 8.21 percent a year. currently, the stock is priced at $43.40 a share and has a required return of 11.65 percent. what is the dividend yield? 3.20 percent 2.75 percent 3.69 percent

Answers: 3

Business, 22.06.2019 08:00, champ1135

Why is it vital to maintain a designer worksheet? a. it separates the designs chosen for the season from those rejected by the company. b. it keeps a record of all designs created by the designer for a season. c. it charts out the development of an entire line through the season and beyond. d. it tracks the development of a design along with costing and production details. done

Answers: 1

Do you know the correct answer?

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semia...

Questions in other subjects:

History, 29.01.2020 04:10

Physics, 29.01.2020 04:10

English, 29.01.2020 04:10

Biology, 29.01.2020 04:10

Biology, 29.01.2020 04:10

Mathematics, 29.01.2020 04:10