Business, 19.03.2021 18:50, anaalashay

US Apparel (USA) manufactures plain white and solid-colored T-shirts. Budgeted inputs include the following

Price Quantity Cost per unit of output

fabric $8 per yard 0.75 yards per unit $6 per unit

labor $16 per DMLH 0.25 DMLH per unit $4 per unit

dye $0.50 per ounce 4 ounces per unit $2 per unit

For colored T-shirts only

Budgeted sales and selling price per unit is as follow:s:

Budgeted Sales Selling Price per Unit

White T-shirts 10,000 units $12 per T-shirt

Colored T-shirts 50,000 units $15 per T-shirt

The USA has the opportunity to switch from using the dye it currently uses to using an environmentally friendly dye that costs $1.25 per ounce. The company would still need 4 ounces of dye per shirt. The USA is reluctant to change because of the increase in costs (and decrease in profit), but the Environmental Protection Agency has threatened to fine the company $130,000 if it continues to use the harmful but less expensive dye

a. Given the preceding information, would the USA be better off financially by switching to the environmentally friendly dye? (Assume all other costs would remain the same.)

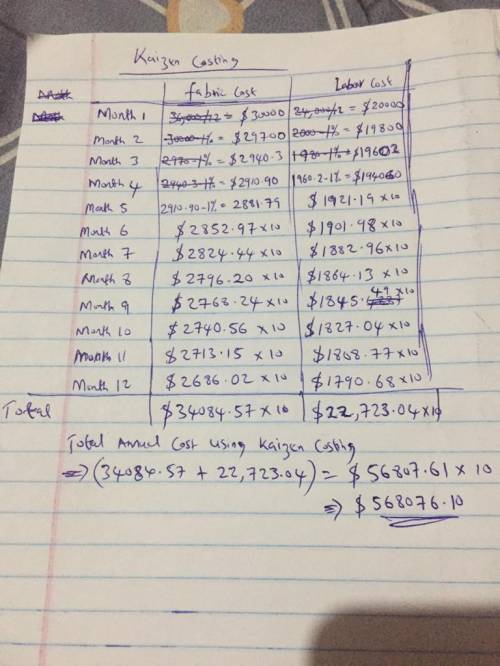

b. Assume the USA chooses to be environmentally responsible regardless of cost, and it switches to the new dye. The production manager suggests trying Kaizen costing. If the USA can reduce fabric and labor costs each by 1% per month on all the shirts it manufactures, by how much will overall costs decrease at the end of 12 months? (Round to the nearest dollar for calculating cost reductions.)

c. Refer to requirement 2. How could the reduction in material and labor costs be accomplished? Are there any problems with this plan?.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:10, angellove1707

You are the new chief information officer for the video-game developer, necturus games. the company has recently undergone a major expansion of its primary product, and you must staff up the is department and determine the best way to develop new game "capsules" for the game, "escape velocity."

Answers: 1

Business, 22.06.2019 20:20, Carloslogrono10

Gamegirl inc., has the following transactions during august. august 6 sold 76 handheld game devices for $230 each to ds unlimited on account, terms 2/10, net 60. the cost of the 76 game devices sold, was $210 each. august 10 ds unlimited returned six game devices purchased on 6th august since they were defective. august 14 received full amount due from ds unlimited. required: prepare the transactions for gamegirl, inc., assuming the company uses a perpetual inventory syste

Answers: 2

Business, 22.06.2019 21:50, elijahjacksonrp6z2o7

The third program provides families with $50 in food stamps each week, redeemable for both perishable and nonperishable food. the fourth policy instead provides a family with a box of nonperishable foods each week, worth $50. use two graphs to illustrate that a family may be indifferent between the two programs, but will never prefer the $50 box of nonperishable foods over the $50 in food stamps. state your answer and use a consumer choice model for perishable food and nonperishable food to graphically justify your choice.

Answers: 1

Business, 23.06.2019 12:00, kaylallangari1509

What could increase the value of your property

Answers: 1

Do you know the correct answer?

US Apparel (USA) manufactures plain white and solid-colored T-shirts. Budgeted inputs include the fo...

Questions in other subjects:

Social Studies, 03.12.2019 14:31

Mathematics, 03.12.2019 14:31

Mathematics, 03.12.2019 14:31

Mathematics, 03.12.2019 14:31

Social Studies, 03.12.2019 14:31