As of January 1, 2017, Aristotle Inc. adopted the retail method of accounting for its merchandise inventory.

To prepare the store’s financial statements at June 30, 2017, you obtain the following data.

Cost Selling Price

Inventory, January 1 $ 30,000 $ 43,000

Markdowns 10,500

Markups 9,200

Markdown cancellations 6,500

Markup cancellations 3,200

Purchases 104,800 155,000

Sales revenue 154,000

Purchase returns 2,800 4,000

Sales returns and allowances 8,000

Instructions

(a) Prepare a schedule to compute Aristotle’s June 30, 2017, inventory under the conventional retail method of accounting for inventories.

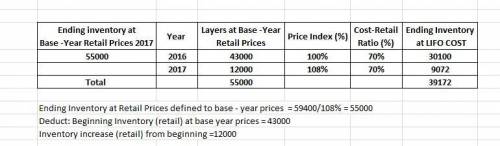

(b) Without prejudice to your solution to part (a), assume that you computed the June 30, 2017, inventory to be $59,400 at retail and the ratio of cost to retail to be 70%. The general price level has increased from 100 at January 1, 2017, to 108 at June 30, 2017. Prepare a schedule to compute the June 30, 2017, inventory at the June 30 price level under the dollarvalue LIFO retail method.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, saykblahwah309

Long-distance providers are becoming increasingly concerned about certain activities within their industry. various companies come together voluntarily to implement new standards of social responsibility that members must abide by. what seems to be the primary motivation in this case for an increased interest in social responsibility? - because corporations are creations of society, they are responsible for giving back to the communities in which they operate.- these companies have realized it is in their best interest to increase their social responsibility before they are once again subject to stricter regulations.- these companies are using social responsibility as a means to increase their profitability, both short term and long term.- long-distance providers have started taking pride in their industry and its record for social responsibility.- they feel a responsibility to their stockholders, employees, the government, investors, and society as a whole.

Answers: 2

Business, 22.06.2019 05:30, tommyaberman

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 21:10, winterblanco

The blumer company entered into the following transactions during 2012: 1. the company was started with $22,000 of common stock issued to investors for cash. 2. on july 1, the company purchased land that cost $15,500 cash. 3. there were $700 of supplies purchased on account. 4. sales on account amounted to $9,500. 5. cash collections of receivables were $5,500. 6. on october 1, 2012, the company paid $3,600 in advance for a 12-month insurance policy that became effective on october 1. 7. supplies on hand as of december 31, 2010 amounted to $225. the amount of cash flow from investing activities would be:

Answers: 2

Do you know the correct answer?

As of January 1, 2017, Aristotle Inc. adopted the retail method of accounting for its merchandise in...

Questions in other subjects:

Mathematics, 21.04.2020 16:29