Business, 10.03.2021 05:40, dyanaycooper13

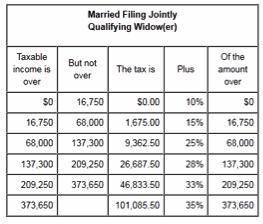

Floyd is married, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a Roth IRA. His household income is currently $105,000 per year, and he expects it to be $225,000 per year when he takes his money out of his IRA. He also expects his $5000 investment to triple in value by the time he takes his money out. Use this information and the tax table below to assist Floyd in making his decision.

Part I: If Floyd chooses a traditional IRA, how much will he pay in taxes now on the $5000?

Part II: If Floyd chooses a traditional IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part III: If Floyd chooses a Roth IRA, how much will he pay in taxes now on the $5000?

Part IV: If Floyd chooses a Roth IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part V: Will choosing a traditional IRA or a Roth IRA cause Floyd to pay more in taxes? How much more will Floyd pay?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 20:00, ethanyayger

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

Business, 22.06.2019 20:10, Zayybabii

With signals from no-claim bonuses and deductibles, a. the marginal cost curve for careful drivers lies to the left of the marginal cost curve for aggressive drivers b. auto insurance companies insure more aggressive drivers than careful drivers because aggressive drivers have a greater need for the insurance c. the market for car insurance has a separating equilibrium, and the market is efficient d. most drivers pay higher premiums than if the market had no signals

Answers: 1

Business, 22.06.2019 21:40, redrhino27501

The farmer's market just paid an annual dividend of $5 on its stock. the growth rate in dividends is expected to be a constant 5 percent per year indefinitely. investors require a 13 percent return on the stock for the first 3 years, a 9 percent return for the next 3 years, a 7 percent return thereafter. what is the current price per share? select one: a. $212.40 b. $220.54 c. $223.09 d. $226.84 e. $227.50 previous pagenext page

Answers: 2

Business, 23.06.2019 09:00, danielahchf

Jorge is attending college next year. he just got information on the college costs and the financial aid package the college is offering. jorge knows his parents can contribute $4,500 each year. jorge’s college costs & financial aid package per year costs financial aid package tuition & fees grants & scholarship $26,000 $18,500 room & board work-study $12,500 $8,500 how much will jorge need to pay each year from his own savings and from loans? $3,000 $7,000 $7,500 $11,500

Answers: 2

Do you know the correct answer?

Floyd is married, and he is trying to decide whether to contribute $5000 to a traditional IRA or to...

Questions in other subjects:

Physics, 06.11.2020 02:40

Mathematics, 06.11.2020 02:40

Computers and Technology, 06.11.2020 02:40

Mathematics, 06.11.2020 02:40

History, 06.11.2020 02:40

Arts, 06.11.2020 02:40