Business, 02.03.2021 02:20, krislinsanchez5221

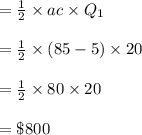

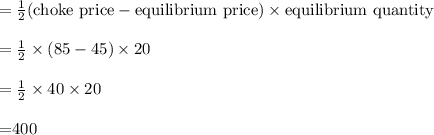

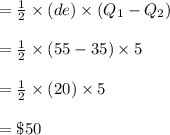

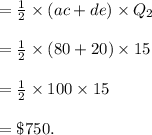

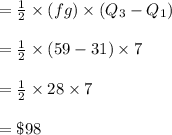

ADVANCED ANALYSIS Assume the following values for the figures below: Q1 = 20 bags. Q2 = 15 bags. Q3 = 27 bags. The market equilibrium price is $45 per bag. The price at a is $85 per bag. The price at c is $5 per bag. The price at f is $59 per bag. The price at g is $31 per bag. Apply the formula for the area of a triangle (Area = ½ × Base × Height) to answer the following questions. Instructions: Enter your answers as a whole number. a. What is the dollar value of the total surplus (= producer surplus + consumer surplus) when the allocatively efficient output level is produced? $ What is the dollar value of the consumer surplus at that output level? $ b. What is the dollar value of the deadweight loss when output level Q2 is produced? $ What is the total surplus when output level Q2 is produced? $ c. What is the dollar value of the deadweight loss when output level Q3 is produced? $

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:00, homeschool0123

Your assessment tool contains rich data about child progress in language and literacy but no details to explain the differences between children. you decide to: a. replace the tool with another b. analyze the data using factors such as language, ability, and participation rates c. review your anecdotal notations regarding language and literacy development d. talk with families about what they are seeing at home

Answers: 2

Business, 21.06.2019 21:30, Taylor73836

Alandowner entered into a written agreement with a real estate broker whereby the broker would receive a commission of 10% of the sale price if he procured a "ready, willing, and able buyer" for the landowner's property and if the sale actually proceeded through closing. the broker found a buyer who agreed in writing to buy the property from the landowner for $100,000, the landowner's asking price. the buyer put up $6,000 as a down payment. the agreement between the landowner and the buyer contained a liquidated damages clause providing that, if the buyer defaulted by failing to tender the balance due of $94,000 at the closing date, damages would be 10% of the purchase price. the landowner included that clause because she was counting on using the proceeds of the sale for a business venture that would likely net her at least $10,000. the buyer became seriously ill and defaulted. when he recovered, he demanded that the landowner return his $6,000, and the landowner refused. the broker also demanded the $6,000 from the landowner and was refused. the broker and the buyer filed separate suits against the landowner, with the buyer pleading impossibility of performance. the two cases are consolidated into a single case. how should the court rule as to the disposition of the $6,000?

Answers: 3

Business, 22.06.2019 10:20, itscheesycheedar

The different concepts in the architecture operating model are aligned with how the business chooses to integrate and standardize with an enterprise solution. in the the technology solution shares data across the enterprise.

Answers: 3

Business, 22.06.2019 17:40, gabe2111

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Do you know the correct answer?

ADVANCED ANALYSIS Assume the following values for the figures below: Q1 = 20 bags. Q2 = 15 bags. Q3...

Questions in other subjects:

Health, 25.06.2019 03:00

Mathematics, 25.06.2019 03:00

Mathematics, 25.06.2019 03:00

Biology, 25.06.2019 03:00

Chemistry, 25.06.2019 03:00

Chemistry, 25.06.2019 03:00

Biology, 25.06.2019 03:00