Business, 19.02.2021 16:40, blacksabbath6922

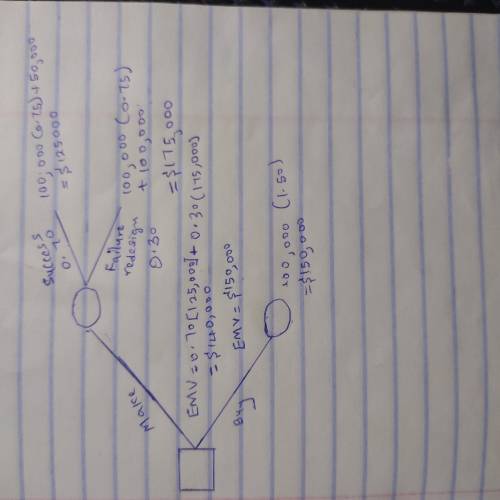

JDI, Inc. is trying to decide whether ro make-or-buy a part (#J-45FPT). Purchasing the part would cost them $1.50 each. If they design and produce it themselves, it will result in a per unit cost of $0.75. However, the design investment would be $50,000. Further, they realize that for this type of part, there is a 30% chance that the part will need to be redesigned at an additional cost of $50,000. Regardless of whether they make-or-buy the part, JDI will need 100,000 of these parts. Using decision trees analysis and EMV, what should JDI do? Show the decision tree.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 22:40, songulakabulut1992

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

Business, 23.06.2019 02:20, lenaeeee

Required information lansing company’s 2017 income statement and selected balance sheet data (for current assets and current liabilities) at december 31, 2016 and 2017, follow. lansing company income statement for year ended december 31, 2017 sales revenue $130,200 expenses cost of goods sold 53,000 depreciation expense 17,500 salaries expense 29,000 rent expense 10,100 insurance expense 4,900 interest expense 4,700 utilities expense 3,900 net income $7,100 lansing company selected balance sheet accounts at december 31 2017 2016 accounts receivable $6,700 $8,000 inventory 3,080 2,090 accounts payable 5,500 6,800 salaries payable 1,100 810 utilities payable 440 270 prepaid insurance 370 500 prepaid rent 440 290 required: prepare the cash flows from operating activities section only of the company’s 2017 statement of cash flows using the indirect method. (amounts to be deducted should be indicated with a minus sign.)

Answers: 1

Business, 23.06.2019 02:50, afropenguin2853

Marcus nurseries inc.'s 2005 balance sheet showed total common equity of $2,050,000, which included $1,750,000 of retained earnings. the company had 100,000 shares of stock outstanding which sold at a price of $57.25 per share. if the firm had net income of $250,000 in 2006 and paid out $100,000 as dividends, what would its book value per share be at the end of 2006, assuming that it neither issued nor retired any common stock?

Answers: 1

Do you know the correct answer?

JDI, Inc. is trying to decide whether ro make-or-buy a part (#J-45FPT). Purchasing the part would co...

Questions in other subjects:

Physics, 07.10.2020 14:01

Spanish, 07.10.2020 14:01