Business, 16.02.2021 04:30, cifjdhhfdu

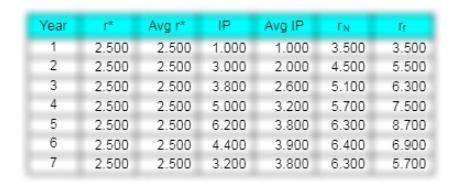

Now assume that the Liquidity Preference theory is correct (versus the data for the Pure Expectations theory above), and the Maturity Risk Premium can be defined as (0.10%)(t-1), where t is the number of years until maturity. Given this information, determine how much $126,000, to be deposited at the beginning of Year 3, and held over Years 3, 4, 5, and 6 (4 years), would be worth at the end of Year 6.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:10, xojade

Maldonia has a comparative advantage in the production of , while lamponia has a comparative advantage in the production of . suppose that maldonia and lamponia specialize in the production of the goods in which each has a comparative advantage. after specialization, the two countries can produce a total of million pounds of lemons and million pounds of coffee.

Answers: 3

Business, 22.06.2019 20:00, mooneyhope24

Experienced problem solvers always consider both the value and units of their answer to a problem. why?

Answers: 3

Business, 22.06.2019 21:20, hellodarkness14

What business practice contributed most to andrew carnegie’s ability to form a monopoly?

Answers: 1

Business, 22.06.2019 23:30, Calumworthy6046

Which career pathways require workers to train at special academies? a. emts and emergency dispatchers b. crossing guards and lifeguards c. police officers and firefighters d. lawyers and judges

Answers: 3

Do you know the correct answer?

Now assume that the Liquidity Preference theory is correct (versus the data for the Pure Expectation...

Questions in other subjects:

Computers and Technology, 21.10.2019 19:10