Business, 12.02.2021 16:50, pupucitomarron

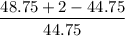

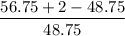

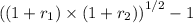

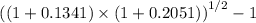

Suppose you purchase one share of the stock of Red Devil Corporation at the beginning of year 1 for $44.75. At the end of year 1, you receive a dividend of $2 and buy one more share for $48.75. At the end of year 2, you receive total dividends of $4 (i. e., $2 for each share), and sell the shares for $56.75 each. What is the time-weighted return on your investment? (Round your answer to 2 decimal places. Do not round intermediate calculations.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:30, ThunderThighsM8

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 21.06.2019 21:00, maliekadeans8499

The following accounts appeared in recent financial statements of delta air lines. identify each account as either a balance sheet account or an income statement account. for each balance sheet account, identify it as an asset, a liability, or stockholders' equity. for each income statement account, identify it as a revenue or an expense. item financial statement type of account accounts payable balance sheet advanced payments for equipment balance sheet air traffic liability balance sheet aircraft fuel (expense) income statement aircraft maintenance (expense) income statement aircraft rent (expense) income statement cargo revenue income statement cash balance sheet contract carrier arrangements (expense) income statement flight equipment balance sheet frequent flyer (obligations) balance sheet fuel inventory balance sheet landing fees (expense) income statement parts and supplies inventories balance sheet passenger commissions (expense) income statement passenger revenue income statement prepaid expenses income statement taxes payable balance sheet

Answers: 1

Business, 21.06.2019 22:30, Gghbhgy4809

An annuity that goes on indefinitely is called a perpetuity. the payments of a perpetuity constitute a/an series. the equation is: a stock with no maturity is an example of a perpetuity. quantitative problem: you own a security that provides an annual dividend of $170 forever. the security’s annual return is 9%. what is the present value of this security? round your answer to the nearest cent. $

Answers: 2

Business, 22.06.2019 01:30, AbyssAndre

Can you post a video on of the question that you need on

Answers: 2

Do you know the correct answer?

Suppose you purchase one share of the stock of Red Devil Corporation at the beginning of year 1 for...

Questions in other subjects:

Mathematics, 12.09.2021 22:30

Health, 12.09.2021 22:30

Mathematics, 12.09.2021 22:30

History, 12.09.2021 22:30

Biology, 12.09.2021 22:30