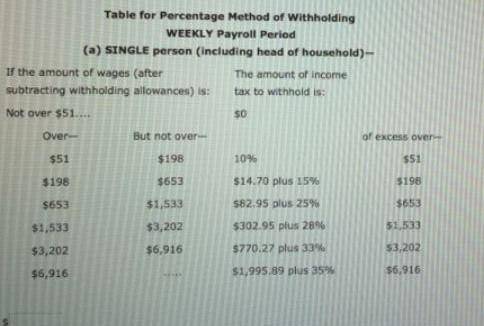

Tam Worldly's weekly gross earnings for the present week were $2,000. Worldly has two exemptions. Using the wage bracket withholding table in Exhibit 2

with a $75 standard withholding allowance for each exemption, what is Worldly's federal income tax withholding? If required, round your answer to two

decimal places.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:20, lauren21bunch

142"what is the value of n? soefon11402bebe99918+19: 00esseeshop60-990 0esle

Answers: 1

Business, 22.06.2019 20:00, dlatricewilcoxp0tsdw

Which of the following statements is true of the balanced-scorecard? a. it is a more or less a one-dimensional metric of measuring competitive advantages of a firm. b. it is one of the traditional approaches of measuring firm performance. c. its primary focus is to base a firm's strategic goals entirely on external performance dimensions. d. it attempts to provide a holistic perspective on firm performance.

Answers: 1

Business, 22.06.2019 21:30, girlhooper4life11

Suppose that alexi and tony can sell all their street tacos for $2 each and all their cuban sandwiches for $7.25 each. if each of them worked 20 hours per week, how should they split their time between the production of street tacos and cuban sandwiches? what is their maximum joint revenue?

Answers: 3

Do you know the correct answer?

Tam Worldly's weekly gross earnings for the present week were $2,000. Worldly has two exemptions. Us...

Questions in other subjects:

Biology, 04.08.2019 11:30

Social Studies, 04.08.2019 11:30