Business, 19.01.2021 19:20, abemorales

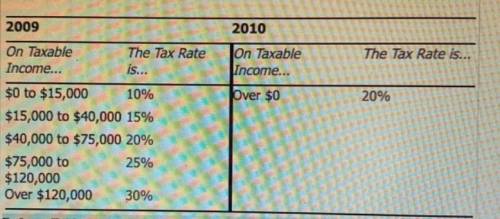

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010

On Taxable The Tax Rate On Taxable The Tax Rate is...

Income... is... Income...

$0 to $15,000 10% Over $0 20%

$15,000 to $40,000 15%

$40,000 to $75,000 20%

$75,000 to 25%

$120,000

Over $120,000 30%

Refer to Table: For an individual who earned $35,000 in taxable income in both years, which of the following describes the change in the individual's marginal tax rate between the two years?

a. The marginal tax rate increased from 2009 to 2010.

b. The marginal tax rate decreased from 2009 to 2010.

c. The marginal tax rate remained constant from 2009 to 2010.

d. The change in the marginal tax rate cannot be determined for the two ta schedules shown.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:00, singfreshjazz3370

Colah company purchased $1.8 million of jackson, inc. 8% bonds at par on july 1, 2018, with interest paid semi-annually. when the bonds were acquired colah decided to elect the fair value option for accounting for its investment. at december 31, 2018, the jackson bonds had a fair value of $2.08 million. colah sold the jackson bonds on july 1, 2019 for $1,620,000. the purchase of the jackson bonds on july 1. interest revenue for the last half of 2018. any year-end 2018 adjusting entries. interest revenue for the first half of 2019. any entry or entries necessary upon sale of the jackson bonds on july 1, 2019. required: 1. prepare colah's journal entries for above transaction.

Answers: 1

Business, 22.06.2019 11:20, tatilynnsoto17

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year. a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs. b. calculate the eoq. c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 17:50, Senica

Bandar industries berhad of malaysia manufactures sporting equipment. one of the company’s products, a football helmet for the north american market, requires a special plastic. during the quarter ending june 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. the plastic cost the company $171,000. according to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a cost of $8 per kilogram. 1. what is the standard quantity of kilograms of plastic (sq) that is allowed to make 35,000 helmets? 2. what is the standard materials cost allowed (sq x sp) to make 35,000 helmets? 3. what is the materials spending variance? 4. what is the materials price variance and the materials quantity variance?

Answers: 1

Business, 23.06.2019 02:00, christiannpettyy

Donna and gary are involved in an automobile accident. gary initiates a lawsuit against donna by filing a complaint. if donna files a motion to dismiss, she is asserting that

Answers: 1

Do you know the correct answer?

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010...

Questions in other subjects:

Social Studies, 07.01.2021 01:00

English, 07.01.2021 01:00

English, 07.01.2021 01:00

Mathematics, 07.01.2021 01:00

English, 07.01.2021 01:00

Mathematics, 07.01.2021 01:00

Mathematics, 07.01.2021 01:00

English, 07.01.2021 01:00