Business, 07.01.2021 04:30, QueenNerdy889

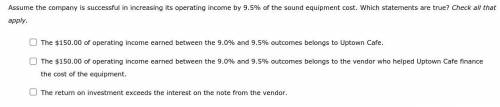

Uptown Cafe wants to begin providing live music in its dining area. The plan will require the company to invest $30,000.00 in sound equipment. The vendor maintains that other restaurants have increased their annual operating income by 8.5% to 9.5% of the cost of the equipment. The vendor has offered to finance $28,000 of the purchase with a 9% note. The remaining capital will come from internal sources. Complete the form to evaluate the effect of financial leverage on the proposed center. Evaluate the earnings potential of the project assuming that operating income will increase by 8.5%, 9.0%, or 9.5% of the equipment cost.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:30, ash011519

On june 1, 2017, blossom company was started with an initial investment in the company of $22,360 cash. here are the assets, liabilities, and common stock of the company at june 30, 2017, and the revenues and expenses for the month of june, its first month of operations: cash $4,960 notes payable $12,720 accounts receivable 4,340 accounts payable 840 service revenue 7,860 supplies expense 1,100 supplies 2,300 maintenance and repairs expense 700 advertising expense 400 utilities expense 200 equipment 26,360 salaries and wages expense 1,760 common stock 22,360 in june, the company issued no additional stock but paid dividends of $1,660. prepare an income statement for the month of june.

Answers: 3

Business, 22.06.2019 14:00, lindjyzeph

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 20:10, boofpack9775

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

Business, 22.06.2019 22:40, kharmaculpepper

Rolston music company is considering the sale of a new sound board used in recording studios. the new board would sell for $27,200, and the company expects to sell 1,570 per year. the company currently sells 2,070 units of its existing model per year. if the new model is introduced, sales of the existing model will fall to 1,890 units per year. the old board retails for $23,100. variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,520,000 per year, and fixed costs are $1,420,000 per year. if the tax rate is 35 percent, what is the annual ocf for the project?

Answers: 1

Do you know the correct answer?

Uptown Cafe wants to begin providing live music in its dining area. The plan will require the compan...

Questions in other subjects:

Chemistry, 02.07.2019 18:20

Mathematics, 02.07.2019 18:20