Business, 06.01.2021 06:30, officialrogerfp3gf2s

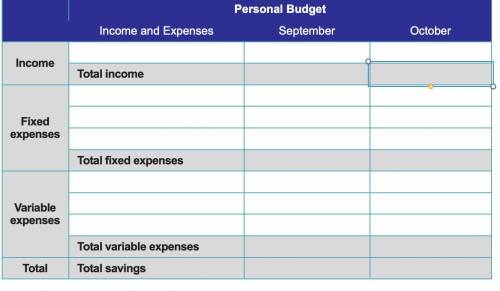

Section 1: Creating a Two-Month Budget

Imagine that you are a college student who lives away from home. You have a work-study job at your college library, and you earn about $600 each month. You have one major long-term goal: you want to save up money to visit your family soon, and you need at least $100 for your train tickets.

Create a budget that will allow you to save at least $100 by the end of October. (10 points)

Make sure your budget includes these fixed expenses:

The cost of rent ($250 each month for your shared apartment)

The cost of your bus pass ($40 each month)

The cost of books ($150, but only in September, at the beginning of the school year)

Make sure your budget considers these variable expense categories:

The cost of food

The cost of clothing

Discretionary spending (money to spend freely)

If changes happen during September or October, which expenses will you be able to change most easily? Give an example of how you could make a change. (5 points)

In which month did you save more money? (5 points)

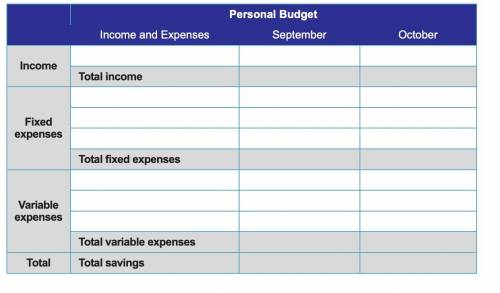

Throughout your life, you will need to adapt your budget to respond to changes in your income and expenses. Now, it is time to practice making changes to a budget.

Change your previous budget to reflect these new factors. (10 points)

Your school announced that you will not have to pay for a bus pass to get to classes, because a new school program will cover this expense for all students.

You just found out that your books will cost more than you had expected. You will now need to spend an additional $100 on books in October.

You got an unexpected raise at work; you will now be making $650 each month.

Make sure that you are still meeting your overall goal of saving $100 by the end of October.

After your budget changed, which month had greater fixed expenses? (5 points)

Which variable expenses did you change in order to maintain your goal of saving at least $100 by the end of October? (5 points)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 09:30, missheyward30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 17:30, gghkooo1987

An essential element of being receptive to messages is to have an open mind true or false

Answers: 2

Business, 22.06.2019 21:40, QueenNerdy889

Which of the following comes after a period of recession in the business cycle? a. stagflation b. a drought c. a boom d. recovery

Answers: 1

Business, 22.06.2019 22:30, jyworthy

Ski powder resort ends its fiscal year on april 30. the business adjusts its accounts monthly, but closes them only at year-end (april 30). the resort's busy season is from december 1 through march 31. adrian pride, the resort's chief financial officer, the museums a close watch on lift ticket revenue and cash. the balances of these accounts at the end of each of the last five months are as follows:

Answers: 3

Do you know the correct answer?

Section 1: Creating a Two-Month Budget

Imagine that you are a college student who lives away from h...

Questions in other subjects:

Mathematics, 27.04.2020 02:22

Mathematics, 27.04.2020 02:22