Business, 03.12.2020 22:20, landonp101

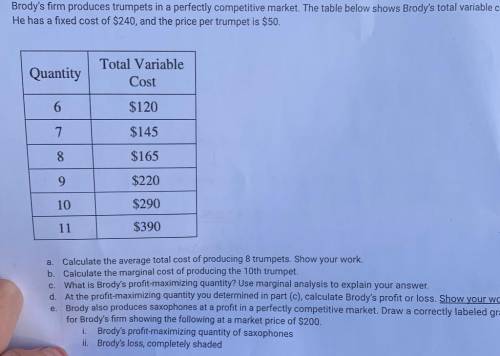

Brody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cl He has a fixed cost of $240, and the price per trumpet is $50.

Total Variable Cost Quantity 6 7 8 $120 $145 $165 $220 10 $290 11 $390

a. Calculate the average total cost of producing 8 trumpets. Show your work.

b. Calculate the marginal cost of producing the 10th trumpet.

c. What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer.

d. At the profit-maximizing quantity you determined in part (C), calculate Brody's profit or loss. Show your work.

e. Brody also produces saxophones at a profit in a perfectly competitive market. Draw a correctly labeled gra for Brody's firm showing the following at a market price of $200.

i Brody's profit-maximizing quantity of saxophones

ii. Brody's loss, completely shaded

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:40, kianofou853

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate. the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received. c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 16:00, leo4687

Advanced enterprises reports year-end information from 2018 as follows: sales (160,250 units) $968,000 cost of goods sold 641,000 gross margin 327,000 operating expenses 263,000 operating income $64,000 advanced is developing the 2019 budget. in 2019 the company would like to increase selling prices by 14.5%, and as a result expects a decrease in sales volume of 9%. all other operating expenses are expected to remain constant. assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. should advanced increase the selling price in 2019?

Answers: 3

Business, 22.06.2019 17:20, sctenk6052

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 22.06.2019 19:30, taylorray0820

Which of the following statements are false regarding activity-based costing? non-manufacturing costs are important to include when calculating the cost of each product. costs are allocated based on a pre-determined overhead rate. transitioning from traditional costing methods to activity-based costing can be complicated and costly. activity-based costing follows the same basic calculation methods as traditional costing approaches. none of the above

Answers: 2

Do you know the correct answer?

Brody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's tota...

Questions in other subjects:

English, 09.12.2020 01:40

Arts, 09.12.2020 01:40

Physics, 09.12.2020 01:40

Mathematics, 09.12.2020 01:40

Mathematics, 09.12.2020 01:40

Mathematics, 09.12.2020 01:40