Business, 02.12.2020 01:10, alexanderickh1

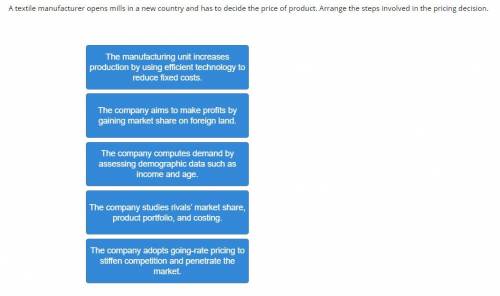

A textile manufacturer opens mills in a new country and has to decide the price of product. Arrange the steps involved in the pricing decision.

The manufacturing unit increases production by using efficient technology to reduce fixed costs.

The company aims to make profits by gaining market share on foreign land.

The company computes demand by assessing demographic data such as income and age.

The company studies rivals’ market share, product portfolio, and costing.

The company adopts going-rate pricing to stiffen competition and penetrate the market.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:40, antbanks3050

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 13:30, bobbycisar1205

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 22.06.2019 21:10, stephany94

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i. e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Do you know the correct answer?

A textile manufacturer opens mills in a new country and has to decide the price of product. Arrange...

Questions in other subjects:

Social Studies, 26.05.2021 16:40

Mathematics, 26.05.2021 16:40

Mathematics, 26.05.2021 16:40

Mathematics, 26.05.2021 16:40

Mathematics, 26.05.2021 16:40

Mathematics, 26.05.2021 16:40