Hello thank you so much for your help so kinda a long question here (multiple parts).

2. The Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. Households deposit $5000 in currency into the bank and that currency is added to reserves.

Recall, to calculate checkable deposits you have to add the original checkable deposits to the new deposit. To calculate required reserves for the deposits, you have to multiply the required reserve ratio (decimal from) by checkable deposits. To calculate excess reserves, you will subtract required reserves from actual reserves.

2.1. What level of excess reserves does the bank now have?

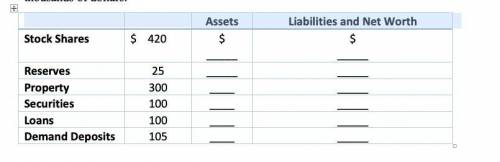

2.2. Complete the table below for the Third National Bank. You have to distinguish between a bank's assets and bank's liabilities.

The figures in the table below are for the Third National Bank. All figures are in thousands of dollars. (Table/chart/graph) normally goes here)

2.3. What is the total assets of this bank? Explain the basics of this bank’s balance sheet.

2.4.If the required reserve ratio for the Third National Bank is 10 percent, what is the monetary multiplier?

(helpful stuff)Recall, to calculate you have to use the formula: Monetary Multiplier = 1÷Required Reserve Ratio. The money multiplier is a key measure in banking that helps to predict the money supply that will be available to drive economic growth. As you can see from the formula, if the reserve requirement is 20%, the money multiplier will be 1 divided by 0.2, which is 5. We can then use the money multiplier multiplied by the excess reserves to determine the maximum checkable-deposit creation that will be provided by the new money entering the system.

2.5. If the monetary multiplier is 4, what is the required reserve ratio? Describe how and identify by what amount the Third National Bank can create money in the economy.

(helpful stuff)Recall that, generally, bank creates money in a typical economy by making loans. The Fed sets the reserve requirement (the required reserve ratio) that directly affects the amount of money creation.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:00, Kate1678

Wallace company provides the following data for next year: month budgeted sales january $120,000 february 108,000 march 140,000 april 147,000 the gross profit rate is 35% of sales. inventory at the end of december is $29,600 and target ending inventory levels are 10% of next month's sales, stated at cost. what is the amount of purchases budgeted for january?

Answers: 1

Business, 22.06.2019 15:40, brashley

Acompany manufactures x units of product a and y units of product b, on two machines, i and ii. it has been determined that the company will realize a profit of $3 on each unit of product a and $4 on each unit of product b. to manufacture a unit of product a requires 7 min on machine i and 5 min on machine ii. to manufacture a unit of product b requires 8 min on mchine i and 5 min on machine ii. there are 175 min available on machine i and 125 min available on machine ii in each work shift. how many units of a product should be produced in each shift to maximize the company's profit p?

Answers: 2

Business, 22.06.2019 17:00, HourlongNine342

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 18:00, firesoccer53881

If you would like to ask a question you will have to spend some points

Answers: 1

Do you know the correct answer?

Hello thank you so much for your help so kinda a long question here (multiple parts).

2. The Third...

Questions in other subjects:

Mathematics, 21.01.2021 21:10

History, 21.01.2021 21:10

Mathematics, 21.01.2021 21:10

Mathematics, 21.01.2021 21:10

Mathematics, 21.01.2021 21:10