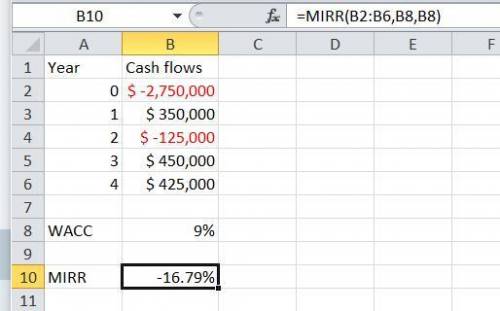

Celestial Crane Cosmetics is analyzing a project that requires an initial investment of $2,750,000. The project’s expected cash flows are:

Year Cash Flow

1 $350,000

2 -125,000

3 450,000

4 425,000

Celestial Crane Cosmetics's WACC is 9%, and the project has the same risk as the firm's average project.

1. Calculate this project's modified internal rate of return (MIRR). Choose from the options given below:

a. 23.25%

b. 17.19%

c. 24.26%

d. -18.52%

2. If Celestial Crane Cosmetics's managers select projects based on the MIRR criterion, they should _ _ _ _ _ this independent project.

Answers: 2

Other questions on the subject: Business

Business, 23.06.2019 02:10, netflixacc0107

Ben is the owner of a small organization with a few employees. he plans to have a data warehouse for the limited number of users in his organization. which data warehouse is most suited for ben's organization? o a. lan-based o b. stationary o c. distributed od. virtual

Answers: 2

Business, 23.06.2019 03:20, brittanysanders

Draw, label and explain the circular flow model (cfm). include the following: firms, households, product market, and factor (or resource) market. who owns the productive resources? what are those resources? what payment does each type of resource earn? explain the two markets in the cfm and explain the roles that firms and household each play in the cfm.

Answers: 2

Business, 23.06.2019 21:00, stef76

You read the newspaper daily. lately, you have noticed more articles about increased tuition at various public and private colleges and universities. you draw the conclusion that all colleges and universities have increased tuition. which type of reasoning is this

Answers: 3

Do you know the correct answer?

Celestial Crane Cosmetics is analyzing a project that requires an initial investment of $2,750,000....

Questions in other subjects:

Mathematics, 19.03.2021 01:00

English, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00

Mathematics, 19.03.2021 01:00