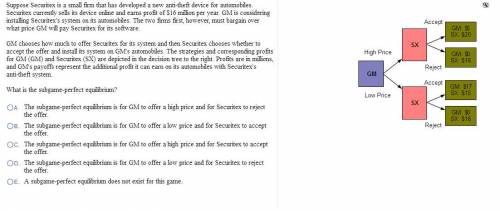

Suppose Securitex is a small firm that has developed a new anti-theft device for automobiles. Securitex currently sells its device online and earns profit of $1515 million per year. GM is considering installing Securitex's system on its automobiles. The two firms first, however, must bargain over what price GM will pay Securitex for its software. GM chooses how much to offer Securitex for its system and then Securitex chooses whether to accept the offer and install its system on GM's automobiles. The strategies and corresponding profits for GM (GM) and Securitex (SX) are depicted in the decision tree to the right. Profits are in millions, and GM's payoffs represent the additional profit it can earn on its automobiles with Securitex's anti-theft system. What is the subgame-perfect equilibrium

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:00, dxpebetty64

Which statement best describes the variety of workplaces commonly found in the health science career cluster? a. workplaces in this cluster include healthcare facilities such as hospitals, physician offices, and clinics. b. workplaces in this cluster include healthcare facilities, laboratories, and other environments such as offices or homes. c . workplaces in this cluster include nonprofit hospitals, government-run clinics, and private physicians' offices. d. workplaces in this cluster include private and nonprofit hospitals and clinics, and dentists' offices.

Answers: 1

Business, 22.06.2019 11:30, deedivinya

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

Business, 22.06.2019 12:10, weeman6546

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

Do you know the correct answer?

Suppose Securitex is a small firm that has developed a new anti-theft device for automobiles. Securi...

Questions in other subjects:

Mathematics, 15.12.2021 09:10

Computers and Technology, 15.12.2021 09:20

Mathematics, 15.12.2021 09:20

Mathematics, 15.12.2021 09:20

Social Studies, 15.12.2021 09:20

Mathematics, 15.12.2021 09:20