Business, 16.11.2020 16:50, kourismith13

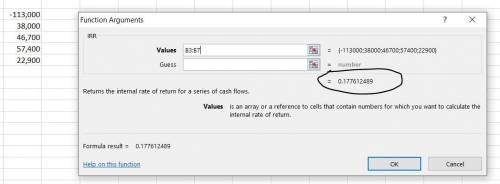

Iron Works International is considering a project that will produce annual cash flows of $38,000, $46,700, $57,400, and $22,900 over the next four years, respectively. What is the internal rate of return if the project has an initial cost of $113,000

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:40, maddied2443

The following pertains to smoke, inc.’s investment in debt securities: on december 31, year 3, smoke reclassified a security acquired during the year for $70,000. it had a $50,000 fair value when it was reclassified from trading to available-for-sale. an available-for-sale security costing $75,000, written down to $30,000 in year 2 because of an other-than-temporary impairment of fair value, had a $60,000 fair value on december 31, year 3. what is the net effect of the above items on smoke’s net income for the year ended december 31, year 3?

Answers: 3

Business, 23.06.2019 02:00, simplychan

Present values. the 2-year discount factor is .92. what is the present value of $1 to be received in year 2? what is the present value of $2,000? (lo5-2)

Answers: 3

Business, 23.06.2019 13:30, DakotaOliver

What is baruch shemtov's product, and how did he begin creating it? (site 1)

Answers: 3

Do you know the correct answer?

Iron Works International is considering a project that will produce annual cash flows of $38,000, $4...

Questions in other subjects:

Mathematics, 19.10.2021 20:50

Physics, 19.10.2021 20:50

English, 19.10.2021 20:50

Mathematics, 19.10.2021 20:50

Mathematics, 19.10.2021 20:50