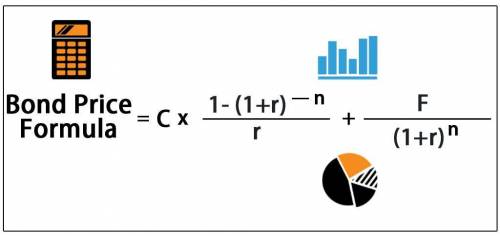

Gugenheim, Inc., has a bond outstanding with a coupon rate of 5.9 percent and annual payments. The yield to maturity is 7.1 percent and the bond matures in 15 years. What is the market price if the bond has a par value of $2,000?

a. $1,785.53

b. $1,782.78

c. $1,787.88

d. $1,780.67

e. $1,818.44

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 16:30, cadenbukvich9923

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Business, 22.06.2019 19:30, jaybeast40

Oz makes lion food out of giraffe and gazelle meat. giraffe meat has 18 grams of protein and 36 grams of fat per pound, while gazelle meat has 36 grams of protein and 18 grams of fat per pound. a batch of lion food must contain at least "46,800" grams of protein and 70,200 grams of fat. giraffe meat costs $1/pound and gazelle meat costs $2/pound. how many pounds of each should go into each batch of lion food in order to minimize costs? hint [see example 2.]

Answers: 1

Business, 23.06.2019 02:10, chasadyyy

Which of the following describes a situation in which there would be decreasing marginal utility? a. buying only necessities. b. buying a car to substitute for riding the bus. c. buying food in bulk to save money in the long run. d. buying a second winter coat.

Answers: 2

Do you know the correct answer?

Gugenheim, Inc., has a bond outstanding with a coupon rate of 5.9 percent and annual payments. The y...

Questions in other subjects:

Social Studies, 06.07.2019 01:10