Business, 27.10.2020 17:50, marchellepenuliar

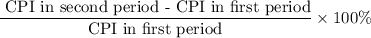

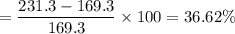

Between 2000 and 2013, the CPI rose from 169.3 to 231.3. This implies that the average annual rate of inflation over the period was:

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:30, bri9263

The amberssen specialty company is a chain of twelve retail stores that sell a variety of imported gift items, gourmet chocolates, cheeses, and wines in the toronto area. amberssen has an is staff of three people who have created a simple but effective information system of networked point-of-sale registers at the stores and a centralized accounting system at the company head- quarters. harry hilman, the head of amberssens is group, has just received the following memo from bill amberssen, sales director (and son of amberssen’s founder). harry—it’s time amberssen specialty launched itself on the internet. many of our competitors are already there, selling to customers without the expense of a retail storefront, and we should be there too. i project that we could double or triple our annual revenues by selling our products on the internet. i’d like to have this ready by - giving, in time for the prime holiday gift-shopping season. bill after pondering this memo for several days, harry scheduled a meeting with bill so that he could clarify bill’s vision of this venture. using the standard con- tent of a system request as your guide, prepare a list of questions that harry needs to have answered about this project.

Answers: 1

Business, 22.06.2019 04:00, hahalol123goaway

Which law would encourage more people to become homeowners but not encourage risky loans that could end in foreclosure? options: offering first time homebuyers tax-free accounts to save for down payments requiring all mortgages to be more affordable, interest-only loans outlawing home inspections and appraisals by mortgage companies limiting rent increases to less than 2% a year

Answers: 2

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Do you know the correct answer?

Between 2000 and 2013, the CPI rose from 169.3 to 231.3. This implies that the average annual rate o...

Questions in other subjects:

Mathematics, 15.04.2021 21:00

English, 15.04.2021 21:00

History, 15.04.2021 21:00

Mathematics, 15.04.2021 21:00