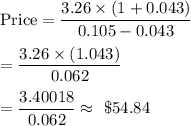

You are considering purchasing stock in Canyon Echo. You feel the company will increase its dividend at 4.3 percent indefinitely. The company just paid a dividend of $3.26 and you feel that the required return on the stock is 10.5 percent. What is the price per share of the company's stock

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:20, abdulalghazouli

Amachine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000: its operating expenses are $60,000 per year. a replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. it has an expected salvage value of $130,000 after nine years. the current disposal value of the old machine is $170,000: if it is kept 9 more years, its residual value would be $20,000. calculate the total costs in keeping the old machine and purchase a new machine. should the old machine be replaced?

Answers: 2

Business, 22.06.2019 01:00, snikergrace

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 15:30, Kiaraboyd9366

The school cafeteria can make pizza for approximately $0.30 a slice. the cost of kitchen use and cafeteria staff runs about $200 per day. the pizza den nearby will deliver whole pizzas for $9.00 each. the cafeteria staff cuts the pizza into eight slices and serves them in the usual cafeteria line. with no cooking duties, the staff can be reduced by half, for a fixed cost of $75 per day. should the school cafeteria make or buy its pizzas?

Answers: 3

Do you know the correct answer?

You are considering purchasing stock in Canyon Echo. You feel the company will increase its dividend...

Questions in other subjects:

Mathematics, 21.01.2021 14:00

Social Studies, 21.01.2021 14:00

Chemistry, 21.01.2021 14:00

History, 21.01.2021 14:00

Mathematics, 21.01.2021 14:00