Business, 23.10.2020 15:50, zhellyyyyy

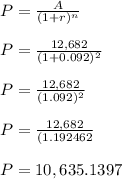

You are borrowing money today at 9.2 percent, compounded annually. You will repay the principal plus all the interest in one lump sum of $12,682 two years from today. How much are you borrowing?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:40, ameliaduxha7

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 23:40, bakerj8395

Gif the federal reserve did not regulate fiscal policy, monitor banks and provide services for banks, what would most likely be the economic conditions to transact business in the u. s.? the economy would primarily be based on a barter system rather than a fiat system. there would be no discrimination in lending by local banks. the economy would be less efficient and transactions most likely more costly.

Answers: 1

Business, 23.06.2019 06:00, ladypink94

Part two of threewhich accurately describes a cause for inflation? the federal reserve requires banks to keep more money on reserve. the federal reserve raises interest rates and slows economic activity. the government places too much money into circulation. the government places too little money into circulation. what are consequences of rapid inflation? (select all that apply.) savings accounts become less desirable because interest earned is lower than inflation individual purchasing power increases, which results in an increase in demand. individual purchasing power decreases, which results in a decrease in demand. people postpone purchasing expensive items, such as homes, until prices drop. how does the federal reserve stabilize and safeguard the nation’s economy? (select all that apply.) it distributes currency and oversees fiscal conditions. it implements american monetary policy. it regulates banks and defends consumer credit rights. it regulates and oversees the nasdaq stock exchange. what are functions of the federal reserve? (select all that apply.) it offers financial services within the government. it creates us coins. it prints us dollars. it enters us currency into circulation. how does the federal reserve bank fit into the balance of power among the three branches of the federal government established by the constitution? the chair of the federal reserve is appointed by the president and approved by the senate. the chair of the federal reserve is elected by popular vote. the chair of the federal reserve is appointed by congress and approved by the supreme court. the chair of the federal reserve is appointed in a secret meeting. who appoints the board of governors of the federal reserve system? the us president the us supreme court the us house of representatives the us senatewhy is federal oversight crucial to the operation of the federal reserve bank? the federal reserve is the nation’s central banking system. the federal reserve controls the nomination of legislators to committees. the federal reserve funds mandatory government expenditures. the federal reserve sets rules and regulations for the new york stock exchange. what is the government accountability office (gao)? an independent agency that answers to congress and audits the federal reserve an internal review agency of the federal reserve used to promote its mission a government agency that answers to congress and audits the united states mint a private agency that advises the dent about fiscal policyhow does the law of comparable advantage lead to international trade? countries that do not engage in trade are in a stronger position economically than countries that do trade. countries that cannot produce products efficiently have to trade for the goods and services that other countries have. countries that have more resources are able to trade for a wider variety of items that can be offered for sale. countries make products they can produce efficiently and are able to get the rest of what they need through trade. when might a country produce a product even though it cannot do so efficiently? (select all that apply.) to ensure national security to minimize the sale of exports to ensure a trade deficit to increase the balance of trade

Answers: 3

Business, 23.06.2019 14:30, lavardamon123

Accounting! will give five star the bixby co. had the following transactions involving the purchase of merchandise. prepare the necessary general journal entries. any applicable freight costs are prepaid by the seller. the perpetual inventory method is in use. june 16 purchased merchandise having a price of 6,000 from the shelby manufacturing co. on account with credit terms 2/10, n/30. transportation terms fob destination. june 16 purchased merchandise having a price of 9,000 from the ajax supply house on account with credit terms 2/10, n/30. transportation terms fob shipping point. the freight costs were 175. june 17 received the goods from shelby june 17 received the goods from ajax june 20 returned for credit merchandise with an invoice price of 800 to ajax june 25 paid shelby the amount owed june 28 paid ajax the amount owed june 30 returned for cash, merchandise with an invoice price of 400 to shelby questions: prepare the necessary general journal entry for june 16, purchased merchandise having a price of 6000 from shelby manufacturing co prepare the necessary general journal entry for june 17, received goods from shelby merchandise inventory 6000 prepare the necessary general journal entry for june 25 prepare the necessary general journal entry for june 28

Answers: 3

Do you know the correct answer?

You are borrowing money today at 9.2 percent, compounded annually. You will repay the principal plus...

Questions in other subjects:

English, 28.10.2019 05:31

History, 28.10.2019 05:31

Mathematics, 28.10.2019 05:31

Mathematics, 28.10.2019 05:31

Biology, 28.10.2019 05:31