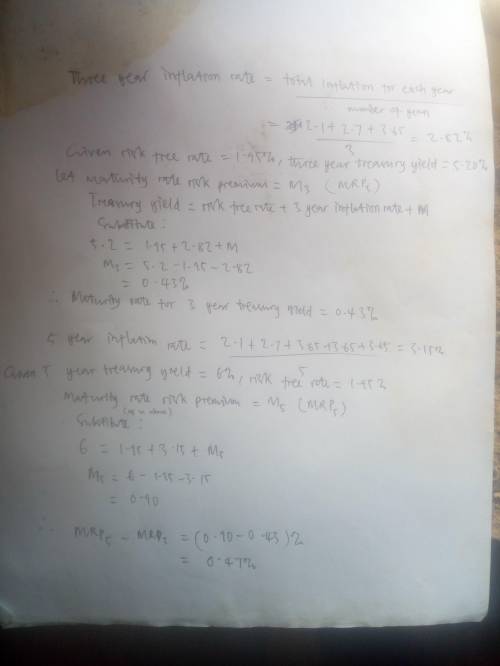

MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.1% in Year 1, 2.7% in Year 2, and 3.65% each year thereafter. Assume that the real risk-free rate is 1.95% and that this rate will remain constant. Three-year Treasury securities yield 5.20%, while 5-year Treasury securities yield 6.00%. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:50, abcdefg87

Consider each of the following cases: case accounting break-even unit price unit variable cost fixed costs depreciation 1 127,400 $ 38 $ 25 $ 711,000 ? 2 124,000 ? 41 2,500,000 $ 900,000 3 5,753 117 ? 171,000 100,000 required: (a) find the depreciation for case 1. (do not round your intermediate calculations.) (b) find the unit price for case 2. (do not round your intermediate calculations.) (c) find the unit variable cost for case 3. (do not round your intermediate calculations.)

Answers: 2

Business, 22.06.2019 15:20, rasv3491

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u. s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 18:00, tifftiff22

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

Do you know the correct answer?

MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.1% in Year 1, 2.7...

Questions in other subjects:

Mathematics, 09.02.2021 04:20

Biology, 09.02.2021 04:20

Mathematics, 09.02.2021 04:20