Business, 20.10.2020 20:01, makayla10119

Lonergan Company occasionally uses its accounts receivable to obtain immediate cash. At the end of June 2021, the company had accounts receivable of $1,060,000. Lonergan needs approximately $640,000 to capitalize on a unique investment opportunity. On July 1, 2021, a local bank offers Lonergan the following two alternatives:.

a. Borrow $640,000, sign a note payable, and assign the entire receivable balance as collateral. At the end of each month, a remittance will be made to the bank that equals the amount of receivables collected plus 9% interest on the unpaid balance of the note at the beginning of the period.

b. Transfer $690,000 of specific receivables to the bank without recourse. The bank will charge a 2% factoring fee on the amount of receivables transferred. The bank will collect the receivables directly from customers. The sale criteria are met.

Required:

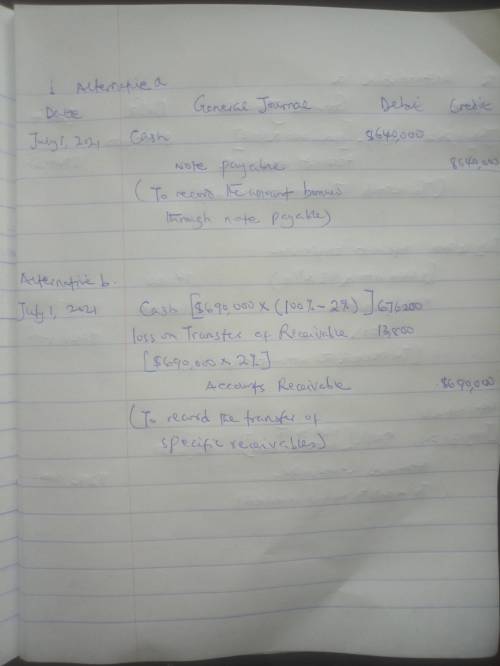

1. Prepare the journal entries that would be recorded on July 1 for

a. alternative a.

b. alternative b

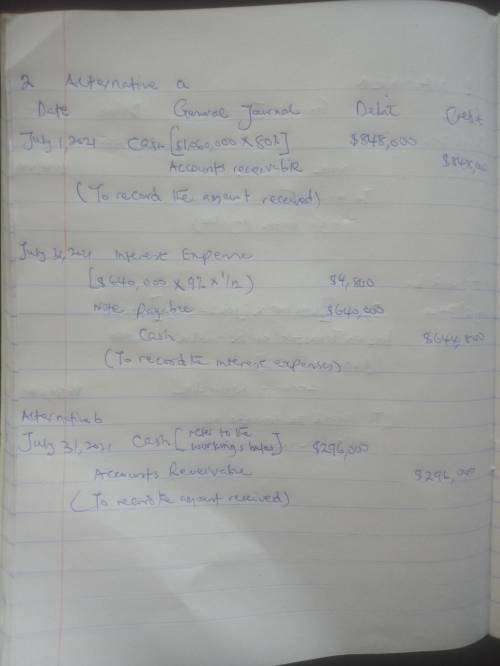

2. Assuming that 80% of all June 30 receivables are collected during July, prepare the necessary journal entries to record the collection and the remittance to the bank for

a. alternative a

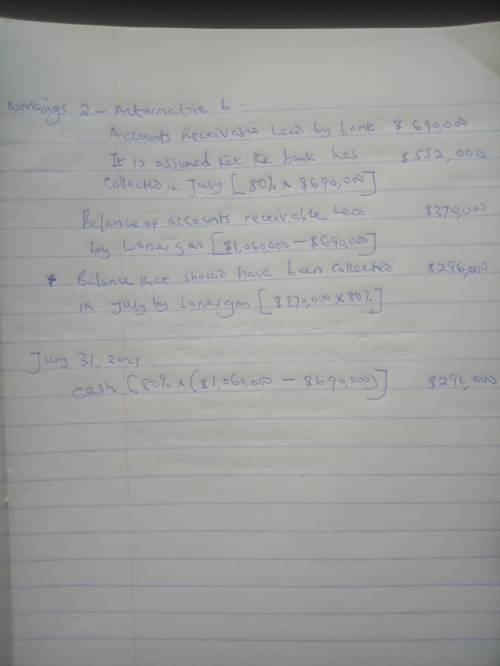

b. alternative b.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 03:30, Emptypockets451

Joe said “your speech was really great, i loved it.” his criticism lacks which component of effective feedback? a) he did not recognize his ethical obligations b) he did not focus on behavior c) he did not stress the positive d) he did not offer any specifics

Answers: 2

Business, 22.06.2019 09:30, missheyward30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 20:00, jaylennkatrina929

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

Business, 22.06.2019 20:20, tytybruce2

Carmen’s beauty salon has estimated monthly financing requirements for the next six months as follows: january $ 9,000 april $ 9,000 february 3,000 may 10,000 march 4,000 june 5,000 short-term financing will be utilized for the next six months. projected annual interest rates are: january 9 % april 16 % february 10 may 12 march 13 june 12 what long-term interest rate would represent a break-even point between using short-term financing and long-term financing?

Answers: 3

Do you know the correct answer?

Lonergan Company occasionally uses its accounts receivable to obtain immediate cash. At the end of J...

Questions in other subjects:

Mathematics, 20.09.2021 14:00

History, 20.09.2021 14:00

History, 20.09.2021 14:00

History, 20.09.2021 14:00

Chemistry, 20.09.2021 14:00

Mathematics, 20.09.2021 14:00