Business, 16.10.2020 18:01, queenpanda365

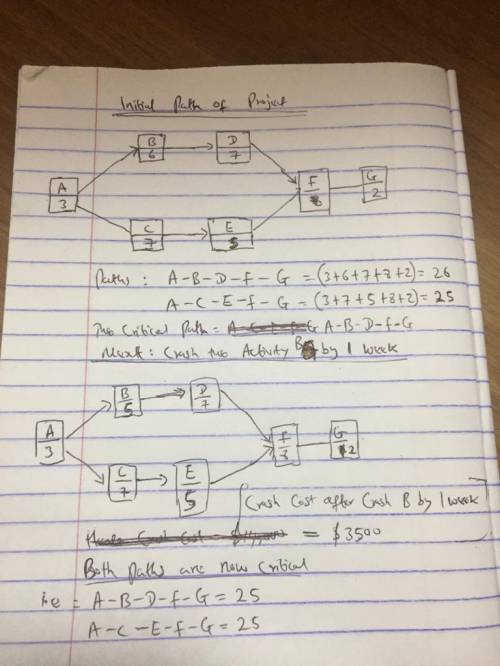

A project manager is faced with the following activities and times associated with a building construction for a cancer research facility. Each activity can be crashed at most by 2 weeks. The cost associated with each week time reduction is given below. (note: The 1st crash and 2nd crash costs are associated with the first and second time that a specific activity is crashed. So, if you crash Activity A once, the cost is $9,000, if you have to crash Activity A a second time, the cost is $9,500)

Crash Costs

Activity Immediate Predecessor Normal Time (weeks) 1st crash 2nd crash

A 3 $9,000 $9,500

B A 6 $3,500 $6,000

C А 7 $4,000 $5,000

D B 7 $4,500 $6,000

E C 5 $7,000 $7,500

F D, E 8 $10,000 $12,000

G F 2 $14,000 $16,000

What is the minimum cost to crash this project by 2 weeks?

a. $12,000

b. $9,000

c. $16,000

d. $3,500

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:30, skyvargasov9cad

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 14:40, kianofou853

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate. the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received. c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 15:20, byler47

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 16:00, ari313

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Do you know the correct answer?

A project manager is faced with the following activities and times associated with a building constr...

Questions in other subjects:

Mathematics, 06.11.2019 02:31

Physics, 06.11.2019 02:31