Business, 13.10.2020 03:01, screamolover1700

The following are selected transactions of Blanco Company. Blanco prepares financial statements quarterly.

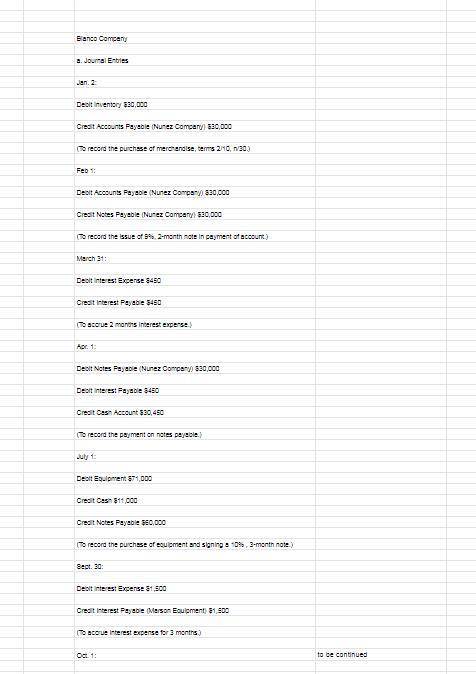

Jan. 2 Purchased merchandise on account from Nunez Company, $30,000, terms 2/10, n/30. (Blanco uses the perpetual inventory system.)

Feb. 1 Issued a 9%, 2-month, $30,000 note to Nunez in payment of account.

Mar. 31 Accrued interest for 2 months on Nunez note.

Apr. 1 Paid face value and interest on Nunez note.

July 1 Purchased equipment from Marson Equipment paying $11,000 in cash and signing a 10%, 3-month, $60,000 note.

Sept. 30 Accrued interest for 3 months on Marson note.

Oct. 1 Paid face value and interest on Marson note.

Dec. 1 Borrowed $24,000 from the Paola Bank by issuing a 3-month, 8% note with a face value of $24,000.

Dec. 31 Recognized interest expense for 1 month on Paola Bank note.

Required:

a. Prepare journal entries for the listed transactions and events.

b. Post to the accounts Notes Payable, Interest Payable, and Interest Expense.

c. Show the balance sheet presentation of notes and interest payable at December 31.

d. What is total interest expense for the year?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 17:40, jjackson0010

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses.

Answers: 3

Business, 22.06.2019 11:30, deedivinya

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

Business, 22.06.2019 22:40, gracebuffum

In a fixed-term, level-payment reverse mortgage, sometimes called a reverse annuity mortgage, or ram, a lender agrees to pay the homeowner a monthly payment, or annuity, and expects to be repaid from the homeowner’s equity when he or she sells the home or obtains other financing to pay off the ram. consider a household that owns a $150,000 home free and clear of mortgage debt. the ram lender agrees to a $100,000 ram for 10 years at 6 percent. assume payments are made annually, at the beginning of each year to the homeowner. calculate the annual payment on the ram.

Answers: 1

Do you know the correct answer?

The following are selected transactions of Blanco Company. Blanco prepares financial statements quar...

Questions in other subjects:

Mathematics, 06.10.2019 18:20

Mathematics, 06.10.2019 18:20

Mathematics, 06.10.2019 18:20

Social Studies, 06.10.2019 18:20

Mathematics, 06.10.2019 18:20

Geography, 06.10.2019 18:30