Business, 12.10.2020 01:01, kerriscaballero12

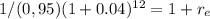

Your company has a line of credit through a local bank. The bank requires a 6% compensating balance and charges 12% on the amount borrowed against the line. If the company needs $100,000 to purchase inventory, find the amount it should borrow, and calculate the effective annual rate on the loan (b) You’ve worked out a line of credit arrangement that allows you to borrow up to $100 million at any time. The interest rate is 0.4 percent per month. In addition, 5% of the amount that you borrow must be deposited in a non-interest bearing account (i. e. a compensating balance). Assume that your bank uses compound interest on its line of credit loans. What is the effective annual rate (EAR) on the loan? W

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:30, nanamath5662

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 19:30, hmae2304

Alaska king crab fishing in the 1960s and '70s was a dangerous but rich fishery. boats from as far away as california and japan braved the treacherous gulf of alaska crossing to reach the abundant king crab beds in cook inlet and bristol bay. suddenly, in the early 1980s, the fishery crashed due to over fishing. all crabbing in those areas ended. to this day, there is no crabbing in bristol bay or cook inlet. a. how would an economist explain the decline of the alaska king crab fishery

Answers: 3

Business, 22.06.2019 20:40, ccory0626

Answer the questions about keynesian theory, market economics, and government policy. keynes believed that there were "sticky" wages and that recessions are caused by increases in prices. decreases in supply. decreases in aggregate demand (ad). increases in unemployment. keynes believed the government should increase ad through increased government spending, but not tax cuts. control wages to increase employment because of sticky wages. increase employment through tax cuts only. increase as through tax cuts. increase ad through either increased government spending or tax cuts. intervene when individual markets fail by controlling prices and production.

Answers: 2

Business, 22.06.2019 20:40, kaylee0424

Financial performance is measured in many ways. requirements 1. explain the difference between lag and lead indicators. 2. the following is a list of financial measures. indicate whether each is a lag or lead indicator: a. income statement shows net income of $100,000 b. listing of next week's orders of $50,000 c. trend showing that average hits on the redesigned website are increasing at 5% per week d. price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 e. contract signed last month with large retail store that guarantees a minimum shelf space for grandpa's overloaded chocolate cookies for the next year

Answers: 2

Do you know the correct answer?

Your company has a line of credit through a local bank. The bank requires a 6% compensating balance...

Questions in other subjects:

Mathematics, 19.01.2021 21:20

World Languages, 19.01.2021 21:20

History, 19.01.2021 21:20

Advanced Placement (AP), 19.01.2021 21:20