Business, 08.10.2020 14:01, Herbie3070

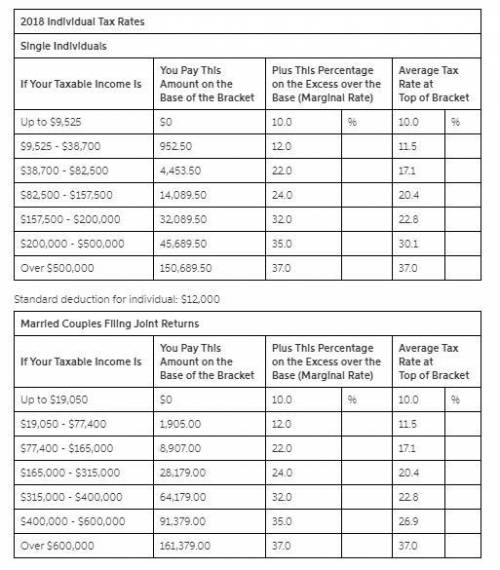

2018 Individual Tax Rates Single Individuals If Your Taxable Income Is You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) Average Tax Rate at Top of Bracket Up to $9,525 $0 10.0 % 10.0 % $9,525 - $38,700 952.50 12.0 11.5 $38,700 - $82,500 4,453.50 22.0 17.1 $82,500 - $157,500 14,089.50 24.0 20.4 $157,500 - $200,000 32,089.50 32.0 22.8 $200,000 - $500,000 45,689.50 35.0 30.1 Over $500,000 150,689.50 37.0 37.0 Standard deduction for individual: $12,000 Married Couples Filing Joint Returns If Your Taxable Income Is You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) Average Tax Rate at Top of Bracket Up to $19,050 $0 10.0 % 10.0 % $19,050 - $77,400 1,905.00 12.0 11.5 $77,400 - $165,000 8,907.00 22.0 17.1 $165,000 - $315,000 28,179.00 24.0 20.4 $315,000 - $400,000 64,179.00 32.0 22.8 $400,000 - $600,000 91,379.00 35.0 26.9 Over $600,000 161,379.00 37.0 37.0 Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $138,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $4,400. How much does Jenna owe to the IRS for taxes

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:50, chloespalding

Assume that the governance committee states that all projects costing more than $70,000 must be reviewed and approved by the chief information officer and the it senior leadership team (slt). at this point, the cio has the responsibility to ensure that management processes observe the governance rules. for example, the project team might present the proposed project in an slt meeting for a vote of approval. what does this scenario illustrate about organizational structure?

Answers: 2

Business, 22.06.2019 09:00, nadiarose6345

Consider the scenario below and let us know if you believe lauren smith's actions to be ethical. let us know why or why not. lauren smith is the controller for sports central, a chain of sporting goods stores. she has been asked to recommend a site for a new store. lauren has an uncle who owns a shopping plaza in the area of town where the new store is to be located, so she decides to contact her uncle about leasing space in his plaza. lauren also contacted several other shopping plazas and malls, but her uncle’s store turned out to be the most economical place to lease. therefore, lauren recommended locating the new store in her uncle’s shopping plaza. in making her recommendation to management, she did not disclose that her uncle owns the shopping plaza. if management decided to go with lauren's uncle's plaza, what additional information would be needed in the financial statements?

Answers: 2

Business, 22.06.2019 11:00, igtguith

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 23.06.2019 01:10, aris35

Hillside issues $4,000,000 of 6%, 15-year bonds dated january 1, 2016, that pay interest semiannually on june 30 and december 31. the bonds are issued at a price of $4,895,980. required: 1. prepare the january 1, 2016, journal entry to record the bonds’ issuance

Answers: 3

Do you know the correct answer?

2018 Individual Tax Rates Single Individuals If Your Taxable Income Is You Pay This Amount on the Ba...

Questions in other subjects:

History, 19.08.2019 05:30

Mathematics, 19.08.2019 05:30

Mathematics, 19.08.2019 05:30

Business, 19.08.2019 05:30